Table of Contents

- What Is Insurance Portal Development?

- 6 Types of Insurance Portals You Can Build for Your Business

- 7 Essential Features of Modern Insurance Web Portal

- Technology Stack Behind Successful Insurance Web Portal Development

- How to Develop an Insurance Portal: 6 Simple Steps

- Emerging Technologies Transforming Insurance Portals

- How Much Does it Cost to Develop an Insurance Portal?

- 4 Common Challenges in Insurance Web Portal Development

- Transform Your Insurance Operations With Monocubed

- Frequently Asked Questions

Are your customers waiting days for updates while competitors offer instant digital service?

Not long ago, managing insurance meant dealing with endless paperwork, phone calls, and in-person visits. Even simple actions—like checking policy status or submitting a claim—required personal assistance, slowing everything down.

Today, the solution lies in insurance portal development—building secure web portals that automate operations, deliver personalized digital experiences, enable instant policy access, simplify claims submission, and offer 24/7 self-service options.

At Monocubed, a leading web portal development company, we’ve helped insurance providers transform how they interact with customers and agents. With years of experience and deep expertise in insurance portal solutions, we’ve created this guide to help you understand how to plan, build, and launch a modern digital insurance platform.

In this guide, you’ll discover:

- Essential features that drive customer adoption and ROI

- Technology stacks powering scalable, secure portals

- Step-by-step development processes with realistic timelines

- Security and compliance requirements (HIPAA, PCI DSS, GDPR)

- Complete cost breakdown and investment planning

- How to choose the right insurance portal development partner

Dive into this guide to learn more about insurance portal development, but first start with its simple definition.

What Is Insurance Portal Development?

Insurance portal development is the process of building a secure, web-based platform that serves as a centralized system for customers, agents, and brokers to access and manage insurance-related services.

Insurance web portal development revolutionizes the way insurance companies operate by replacing traditional paper-based workflows with streamlined digital processes. Instead of customers calling agents to check policy details or submit claims, they simply log into the portal for insurers and policyholders and complete tasks independently.

This shift reduces operational burden on your team while improving customer satisfaction through instant access and transparency.

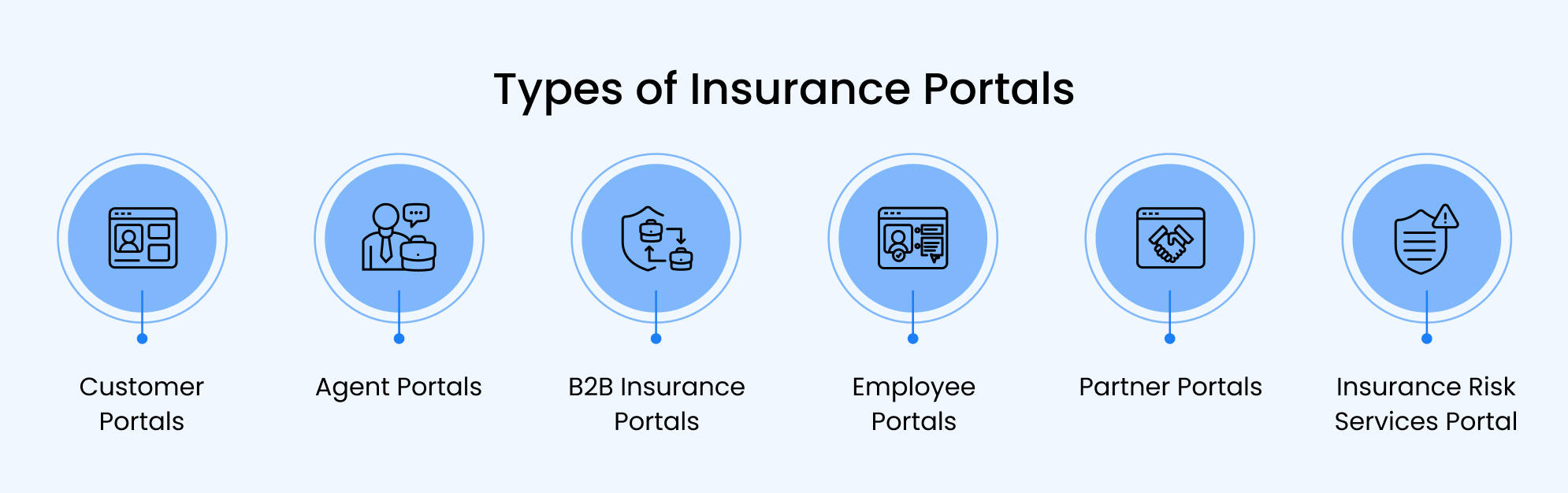

6 Types of Insurance Portals You Can Build for Your Business

Insurance portals can be customized for different user groups within your ecosystem. Each designed to improve efficiency, transparency, and collaboration across operations. Here’s a closer look at the main types:

-

Customer portals

Customer portals empower policyholders with 24/7 access to their insurance information. Users can view and manage policies, file and track claims, upload necessary documents, and make premium payments. Customer portal development helps you build a portal that automates these routine interactions, and insurers can reduce call center inquiries while improving digital experience.

-

Agent/ broker portals

These insurance broker portals equip agents and brokers with advanced tools to manage client portfolios efficiently. The insurance agent portal software development provides a robust platform to generate quotes, submit applications, monitor commissions, and review performance analytics.

-

B2B insurance portals

Built for enterprise clients, B2B portals simplify bulk policy administration, such as employee insurance enrollment, HR system integration, and detailed reporting. Developing an insurance B2B portal enables businesses to manage group policies and benefits programs with greater control and visibility.

-

Employee portals

These employee portals streamline workflows for underwriters, claims adjusters, and administrators by centralizing data and automating internal processes. With insurance employee portal development services, you can eliminate data silos, improve interdepartmental collaboration, and accelerate decision-making within the organization.

-

Partner portals

Partner portal for insurance facilitates secure collaboration with third parties such as reinsurance providers, healthcare partners, or repair networks. By enabling real-time data sharing and integration, they help insurers enhance operational transparency and improve service delivery across the partner ecosystem.

-

Insurance risk services portal

A risk services portal is a specialized type of insurance portal, typically built as a B2B or internal platform for insurance professionals rather than policyholders. Unlike customer-facing portals that focus on policy management and claims, a risk services portal enables insurers to analyze, assess, and monitor risks across portfolios. It improves risk assessment accuracy and enhances regulatory compliance through real-time analytics and reporting.

The right portal type depends on your business model, internal users, and customer engagement goals. So, choose the type of web portal for your insurance agency after analyzing your project requirements, user expectations and business goals.

Which Insurance Portal Fits the Best to Your Needs?

You can talk to our web portal development experts, who have expertise in development insurance portals based on business and user needs.

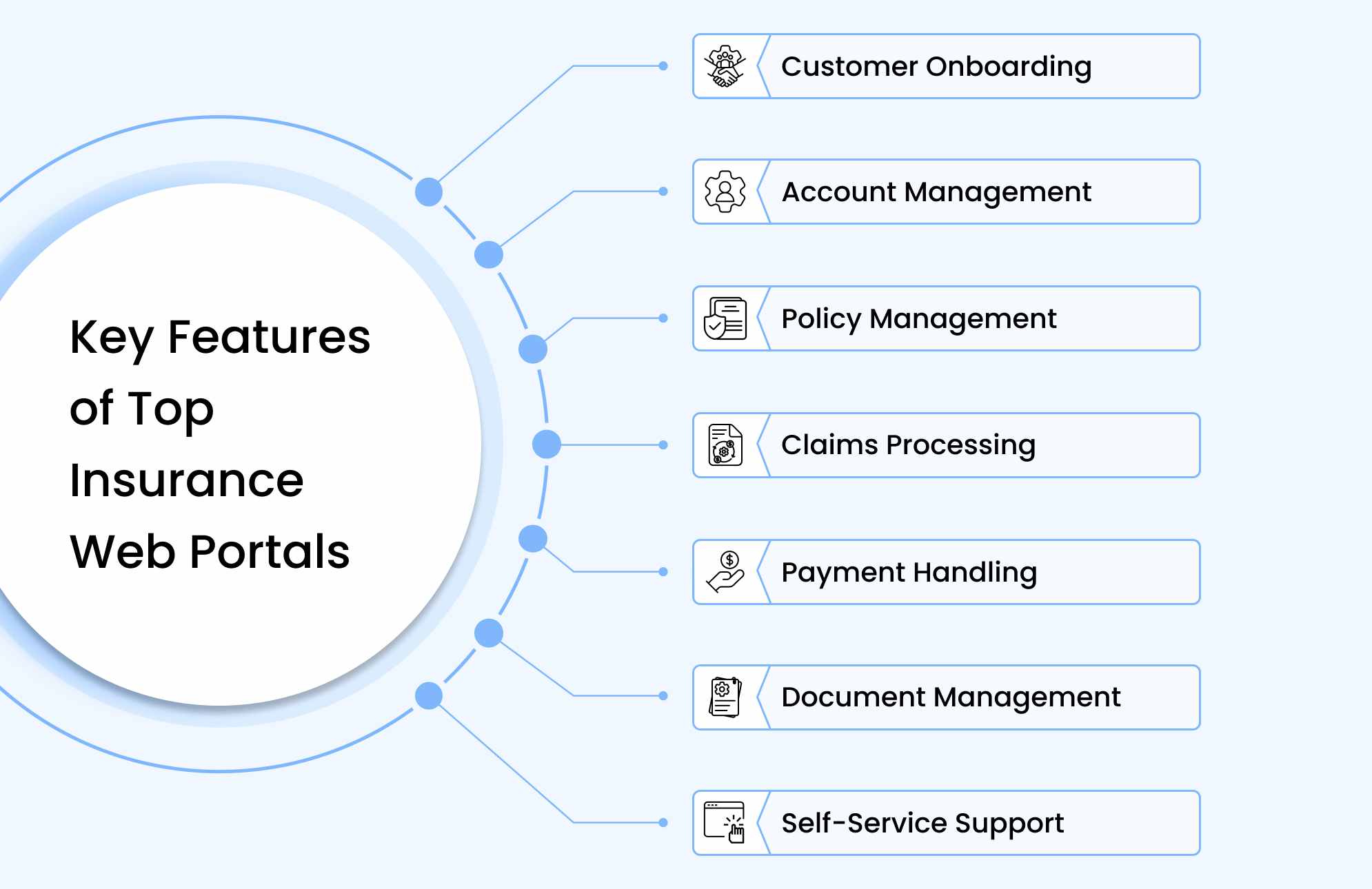

7 Essential Features of Modern Insurance Web Portal

Building a successful web portal insurance starts with getting the core features right. Let’s walk through what your customers actually need.

-

Customer onboarding

First impressions matter. Let customers self-register with configurable forms, verify their identity digitally without paperwork, capture e-signatures electronically, and complete KYC/AML verification automatically based on their location. The easier you make it to sign up, the more customers you’ll convert.

-

Account management

Give customers multi-factor authentication for security, the ability to update personal and billing information themselves, document upload supporting PDFs, images, and videos, and preferences for language, communication channels, and billing methods. Your portal should remember what matters to each customer.

-

Policy management

Your insurance web portal should serve as a one-stop control center. It allows customers to view all active policies in a unified dashboard, download policy documents instantly, modify coverage plans, and renew policies without waiting for an agent. By giving users direct access, you eliminate unnecessary delays and strengthen customer confidence in your brand.

-

Claims processing

Claims handling is where customer loyalty is won or lost. Simplify the process with guided, template-based claim forms, drag-and-drop document uploads, and mobile claim submissions. Display real-time claim status updates and automatically route each claim to the right person or department.

-

Payment handling

An insurance website portal must accept credit cards, ACH, digital wallets, even cryptocurrency, whatever customers prefer. It must be integrated with plugins to allow multi-currency transactions, send automated payment reminders, store complete payment history, and handle installment plans without manual tracking. Remove every payment friction point.

-

Document management

A secure insurance web portal must include centralized document management. Let customers upload, store, and access all policy-related files safely in the cloud. Include search functionality, version control, and digital signatures for easy policy updates or claim verification.

-

Self-service support

Deploy an AI-powered virtual assistant within your insurance web portal to answer customer questions 24/7. Build a searchable knowledge base with helpful articles and FAQs, and add instant messaging for direct communication with specialists. These smart insurance website portal development features significantly reduce routine inquiries and improve customer satisfaction.

- Mobile access: Let customers manage policies, file claims, and make payments from their phones.

- Analytics dashboard: Track claims, renewals, and user activity in real time.

- Automated alerts: Notify users about expiring policies, due payments, and account updates.

- System integration: Connect your CRM, billing, and policy systems to avoid data silos.

Smart and advanced portal features

Enhance your insurance web portal with these smart capabilities:

Get these web portal features right, and you’ll transform your insurance company operations while making customers genuinely happy. Skip them, and you’ve built an expensive web portal nobody uses.

Build Your Insurance Portal With Future-Proof Features

Partner with Monocubed, end-to-end custom web portal development services to launch a customer-centric insurance portal that boosts ROI and automates workflows

Technology Stack Behind Successful Insurance Web Portal Development

Building a reliable insurance portal starts with choosing the right technology stack. Each layer of a web portal plays a crucial role in ensuring performance, scalability, and compliance. Here’s what a modern setup looks like:

| Category | Technologies & Tools | Purpose |

|---|---|---|

| Frontend (User Interface) | HTML5, CSS3, JavaScript, React.js, Angular, Vue.js | These are used to design how your web portal looks and feels, from layouts and buttons to animations and user interactions. |

| Backend (Server Side) | Node.js, Python, PHP, Ruby on Rails, Java, .NET Core | These power the logic behind your web portal. It means handling data, processing requests, and ensuring everything runs smoothly. |

| Database (Data Storage) | MySQL, PostgreSQL, MongoDB, SQL Server | These store all the data your web portal needs like user info, content, and transactions safely and efficiently. |

| Hosting & Cloud Services | AWS, Microsoft Azure, Google Cloud | These platforms host your web portal online, keeping it fast, secure, and available to users anytime. |

| APIs & Integrations | REST, GraphQL, Swagger | API integration tools allow you to connect your web portal with other apps or tools like payment systems, CRMs, or third-party services. |

| Security & User Login | OAuth, JWT, Auth0, SSL/TLS | These security tech stacks protect your web portal and users data and manage logins, permissions, and data encryption. |

| DevOps & Deployment | Docker, Kubernetes, Jenkins, GitHub Actions | These technologies help automate updates, manage servers, and deploy new features quickly without downtime. |

| Testing & Quality Assurance | Jest, Selenium, Cypress | These tools help in testing the portal before launch to fix bugs, improve speed, and ensure everything works as expected. |

| Content Management (CMS) | Strapi, Sanity, WordPress (Headless), Contentful | These make it easy to update website content like blogs, product listings, or news without coding. |

| Analytics & Monitoring | Google Analytics, New Relic, Sentry, Datadog | These allow you to track visitor activity, performance, and technical issues to help improve user experience. |

Choose the right technology stack based on your team’s expertise, scalability goals, and regulatory compliance needs. If you’re unsure where to begin, collaborating with experienced web portal development agencies can help you make the right technical decisions and avoid costly implementation challenges.

Once you decide the technology stack, the next step is to build an insurance web portal for your business. Let’s learn how to do it in the next section.

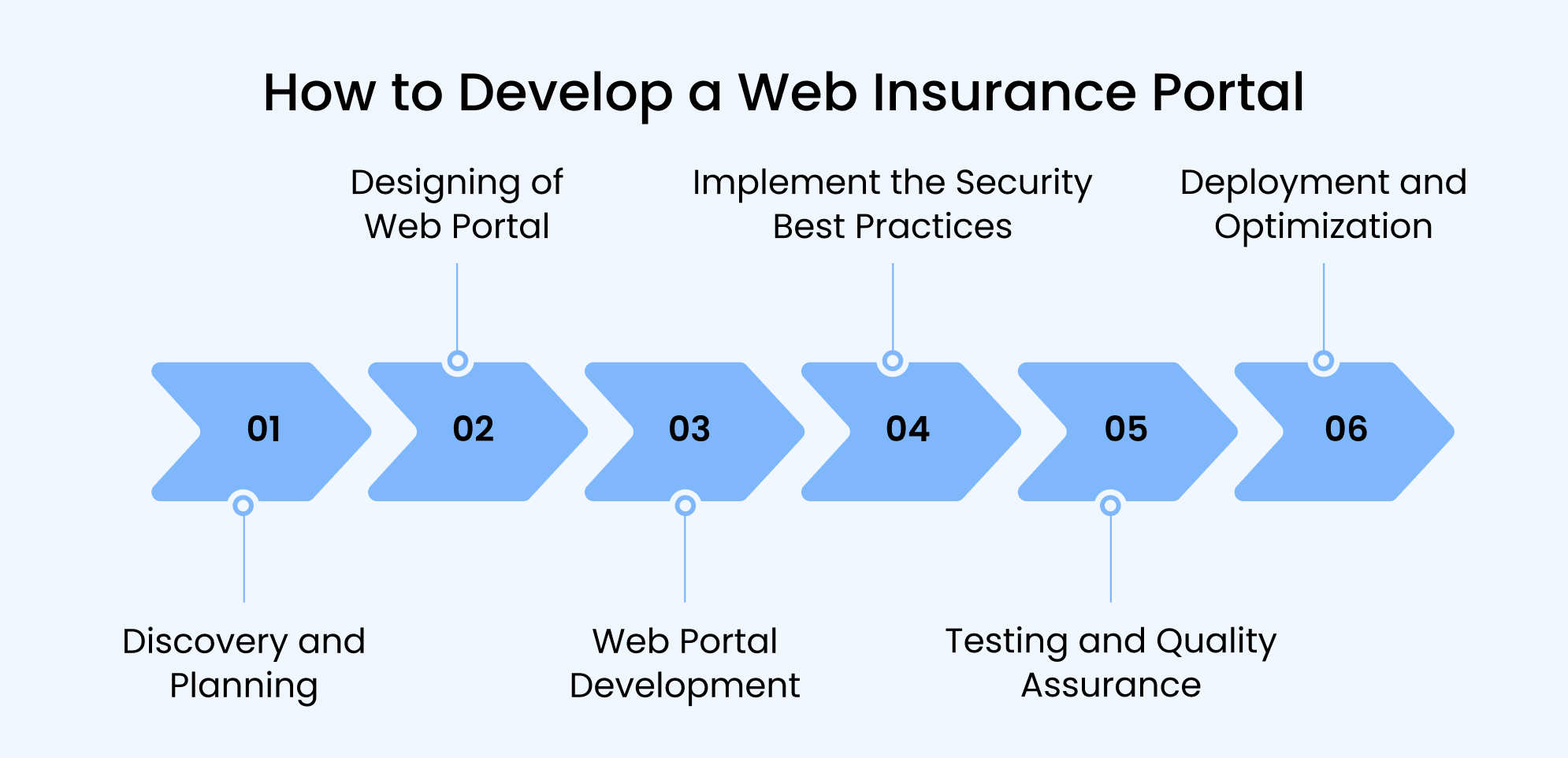

How to Develop an Insurance Portal: 6 Simple Steps

Developing an online insurance web portal is about creating a digital ecosystem where customers, agents, and insurers connect effortlessly. Understanding how to build a web portal for insurance business allows you to invest your money wisely and get the product that transforms complex insurance operations into a smooth experience.

Here’s how the development process brings your insurance portal vision to life, step by step.

-

Discovery and planning

The process starts with understanding your business model, target users, and operational challenges. This helps define the features, user roles, and integrations required for the portal.

- Identify key users such as customers, agents, brokers, and underwriters

- Gather business, functional, and regulatory requirements

- Prioritize essential modules like claims, policy, and payments through an MVP strategy

- Define measurable success metrics, project timelines, and technical scope

This stage ensures alignment between your business goals and the insurance software development team before design begins.

-

Build web portal design and architecture

Once the foundation is clear, the focus shifts to designing an intuitive and scalable insurance portal interface. The aim is to create an easy-to-navigate digital experience backed by a robust system architecture.

- Design user journeys and wireframes for customers and agents

- Create modern UI/UX layouts that simplify policy management and claims tracking

- Build scalable architecture using frameworks like React.js, Angular, and Node.js

- Plan integrations with CRMs, policy administration systems, and third-party APIs

The design and architecture phase for building a website portal for insurance ensures your digital insurance solution is both user-friendly and technically future-ready

-

Web portal development and third-party integration

This phase transforms design into a functional web portal using agile development practices. Developers work on both the front end and back end while ensuring seamless data flow across modules.

- Develop a responsive interface optimized for web and mobile browsers

- Build backend services for authentication, claims processing, and policy renewals

- Use secure RESTful APIs for integrations with CRM, ERP, and payment gateways

- Deploy cloud infrastructure on AWS, Azure, or Google Cloud for scalability and uptime

- Implement encryption, MFA, and access control for user security

By the end of this phase, your insurance management system becomes fully functional with real-time communication between users and internal teams.

-

Implement the security and compliance best practices

Since insurance website portals handle personal and financial data, strong security and regulatory compliance are vital.

- Apply AES-256 encryption for stored data and TLS 1.3 for data transmission

- Enforce multi-factor authentication and role-based access control

- Use Web Application Firewalls (WAFs) and Intrusion Detection Systems (IDS) to detect and block threats

- Ensure HIPAA compliance for health insurance portals with audit trails and log management

- Follow PCI DSS guidelines for secure payment transactions and tokenization

- Implement GDPR workflows for data rights, account deletion, and consent management

- Configure business rules for state-level insurance regulations and reporting

These website security best practices and measures protect sensitive data and help maintain trust and transparency with every user interaction.

-

Testing and quality assurance

Before the deployment, the web software portal undergoes multiple layers of testing to ensure stability, security, and performance under real-world conditions.

- Conduct functional testing for each insurance workflow

- Perform performance and load testing for traffic scalability

- Run security and penetration tests to identify vulnerabilities

- Carry out user acceptance testing (UAT) with agents and policyholders

- Validate compliance with insurance and data protection standards

The security and quality testing guarantees that your online insurance portal runs smoothly and securely for every user type.

-

Deployment and post-launch optimization

Once testing is complete, the insurance portal is deployed to the production environment and monitored for performance and user feedback.

- Migrate existing customer and policy data safely

- Provide training for agents, administrators, and support teams

- Monitor KPIs, analytics, and user interactions for improvement opportunities

- Roll out updates, optimize workflows, and enhance UX based on feedback

- Continuously improve portal performance using AI-driven analytics and automation

Post-launch optimization ensures your insurance web portal remains secure, efficient, and aligned with business growth.

Build and Launch Your Insurance Portal In Just a Few Months

Our agile development process ensures your insurance portal goes live quickly without compromising quality.

Emerging Technologies Transforming Insurance Portals

The insurance industry is evolving rapidly with next-generation technologies that make digital insurance portals smarter, faster, and more customer-centric. From AI-powered automation to IoT-driven insights, these innovations are transforming how insurers serve customers and manage operations.

- Artificial Intelligence (AI): AI helps insurers make faster and more accurate decisions in areas such as underwriting, claims approvals, and fraud detection while improving transparency and trust.

- Machine Learning (ML): ML algorithms analyze patterns in policyholder and claims data to offer personalized recommendations, dynamic pricing, and predictive risk assessment.

- Chatbots and Virtual Assistants: Intelligent chatbots provide instant customer support, answer policy queries, and guide users through claims or renewals without the need for human assistance.

- Optical Character Recognition (OCR): OCR tools extract information from scanned forms or handwritten documents, automating manual data entry and accelerating processing times.

- Computer Vision: This technology evaluates uploaded images, such as car damage photos, to assess claims instantly and generate accurate cost estimates.

- Internet of Things (IoT) and Telematics: Connected devices and telematics systems collect real-time data such as driving behavior or property conditions to assess risks and provide personalized insurance options.

- Cloud Computing: Cloud-based insurance systems enable secure data storage, scalability, and seamless integration between platforms like underwriting, CRM, and claims management.

- Process Automation: Automated workflows simplify policy issuance, claims handling, and compliance reporting, reducing human error and improving operational efficiency.

Together, these technologies are redefining how insurers operate, enabling AI-driven efficiency, personalized customer experiences, and faster claims resolutions through modern online insurance web portals.

How Much Does it Cost to Develop an Insurance Portal?

The cost of insurance portal development typically ranges from $35,000 to over $150,000, depending on the portal’s complexity, features, and integrations. A simple portal with core functionality may start around $35,000, while an enterprise-grade system with AI, automation, and custom modules can exceed $200,000.

Cost breakdown by complexity:

| Portal Type | Estimated Cost (USD) | Description |

|---|---|---|

| Basic Insurance Portal | $35,000 – $60,000 | Includes essential modules like user login, policy management, and claims tracking. Ideal for small agencies or startups. |

| Moderately Complex Portal | $70,000 – $165,000 | Adds custom dashboards, payment integration, and analytics tools. Suitable for mid-sized insurers. |

| Highly Complex Portal | $170,000 – $250,000+ | Features AI-driven automation, CRM integration, multi-role access, and compliance frameworks for large enterprises. |

Key factors influencing insurance portal development cost

- Custom features: Adding advanced modules like AI-powered analytics, personalized dashboards, or risk assessment tools increases the overall cost.

- Third-party integrations: Connecting with CRMs, payment gateways, or underwriting systems requires additional setup and testing.

- Scalability and platform: Multi-platform development or cloud scalability setup can add to the investment.

- Ongoing maintenance: Regular updates, bug fixes, and feature enhancements are recurring costs after deployment.

These are the cost estimates, not the real cost of development. Whether you are looking for an insurance portal development agency or freelancer, ask the total web portal development cost for planning your budget realistically.

Get Your Custom Portal Development Cost Estimate

Get a detailed cost estimate and see how Monocubed helps you reduce development expenses without compromising quality.

4 Common Challenges in Insurance Web Portal Development

Building an insurance web portal comes with its share of challenges. Many insurers struggle to balance modernization with operational efficiency. With Monocubed’s experience in web portal development, these challenges can be addressed through a structured, user-focused approach.

-

Complex implementation and integration

Developing an insurance portal often involves integrating multiple tools like CRM, policy management, and payment systems. Without proper planning, this process can become time-consuming and prone to errors.

-

Solution: Monocubed offers web development consulting services, where web portal experts conduct a thorough technology audit and create a step-by-step development roadmap. This ensures smooth data migration, system integration, and scalability while minimizing disruptions to your operations.

-

High development and maintenance costs

The total cost of an insurance portal includes not only design and development but also maintenance, upgrades, and security. Unexpected expenses can easily stretch budgets.

-

Solution: Monocubed focuses on building scalable MVPs that allow insurers to launch quickly, test user adoption, and expand features as needed. Transparent pricing and post-launch support help keep long-term costs predictable.

-

Lack of digital agility

Adapting to new technology often slows down teams that are used to legacy systems, making the digital shift more difficult.

-

Solution: Monocubed uses agile development practices to ensure flexibility and faster rollouts. By aligning the new portal with existing workflows, insurers can adopt digital tools without major operational disruption.

-

Limited digital literacy

Even well-built portals can fail if the users, especially agents or policy managers who lack the digital skills to use them effectively.

-

Solution: Monocubed designs portals with intuitive, easy-to-navigate interfaces that require minimal technical training. Additional onboarding support and documentation help teams gain confidence using the system efficiently.

By tackling these challenges strategically, insurers can streamline operations, reduce costs, and enhance customer engagement. With Monocubed’s insurance web portal development expertise, your organization can move toward a more connected, agile, and digitally empowered future.

Transform Your Insurance Operations With Monocubed

The Insurance Agency Portal Market is projected to reach $14.34 billion by 2034, as insurers accelerate digital transformation to improve efficiency and customer experience (Source: Custom Market Insights).

Modern technologies such as AI chatbots, predictive analytics, IoT, and blockchain are redefining how insurers manage claims, personalize policies, and ensure transparency.

Yet, technology alone doesn’t guarantee success. The true difference lies in choosing the right web portal development partner who can align innovation with your business goals.

Monocubed specializes in insurance web portal development that bridges this gap. We’ve partnered with providers across health, auto, property, life, and specialty insurance, building custom web portals that simplify operations, enhance user engagement, and maintain compliance. Our approach ensures every solution is secure, scalable, and tailored to your workflow.

Why choose Monocubed:

- Complete end-to-end portal development

- Secure, compliant, and scalable solutions

- Smooth integration with existing systems

- Intuitive and user-focused design

- On-time delivery with flexible engagement models

Now is the time to invest in digital transformation. Every month you wait means losing potential customers to competitors offering faster and smarter digital experiences.

Ready to Build a Secure and Reliable Insurance Web Portal?

Empower your operations with a secure, scalable, and user-friendly insurance portal built by experts who understand your industry.

Frequently Asked Questions About Insurance Portal Development

-

How long does it take to develop an insurance portal?

Insurance portal development timelines range from 5-7 months for basic portals to 9-12 months for enterprise solutions. Timeline depends on complexity, features, integration scope, and customization needs. Our phased approach delivers an MVP faster, then adds advanced features based on feedback.

-

What’s the difference between custom insurance portal development and platform-based portal solutions?

Custom insurance portal development builds portals for your specific requirements, offering complete control over features and integrations. Platform-based solutions use pre-built frameworks, deploying faster at lower cost but potentially limiting customization.

-

Can an insurance portal integrate with existing systems?

Yes. Modern insurance portals can seamlessly integrate with CRM platforms, ERP systems, third-party payment gateways, and cloud services to create unified workflows and real-time data visibility across operations.

At Monocubed, we specialize in building interoperable insurance portals that ensure smooth connectivity between your existing tools and new digital systems, reducing manual effort and improving operational efficiency. -

Why choose a professional web portal development agency for insurance software?

Choosing a professional web portal development agency can make a significant difference in how efficiently your insurance platform performs and scales. Here are various to partner with one of the web portal development companies:

- Ensures scalability and secure architecture

- Adheres to compliance and industry regulations

- Delivers modern, user-centric design and UX

- Provides faster development and deployment timelines

- Offers integration expertise across insurance systems

- Reduces long-term maintenance and operational risks

By Yuvrajsinh Vaghela

By Yuvrajsinh Vaghela