Contents

Struggling to turn your fintech idea into a fully functional web application? You’re not alone. Every failed transaction, every clunky user interface, and every compliance violation represents lost revenue and broken trust with your customers.

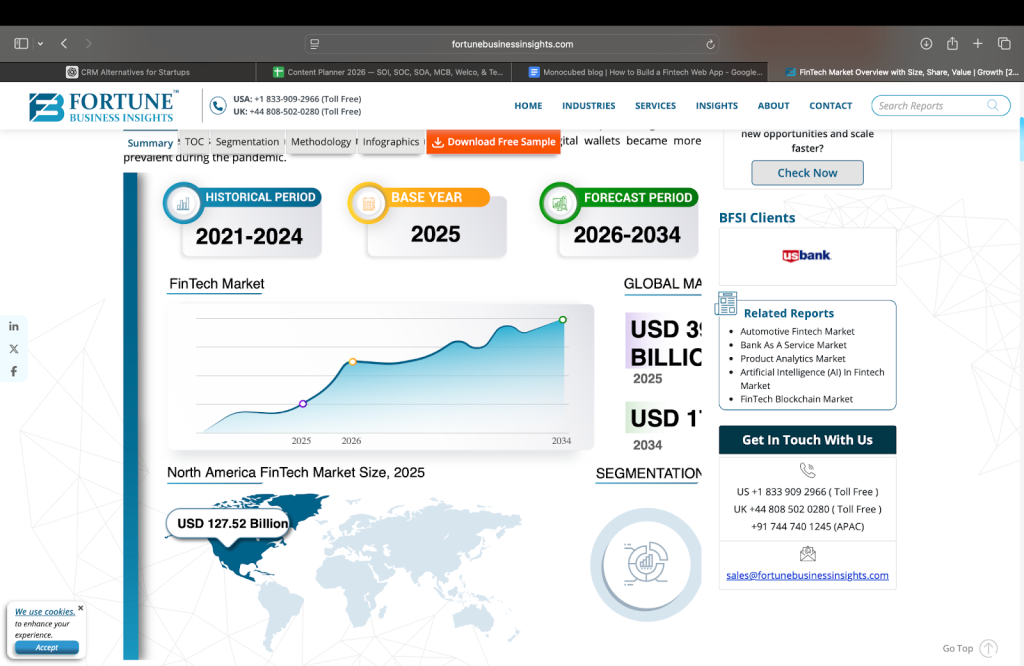

According to Fortune Business Insights, the global fintech market is projected to reach $882 billion by 2030, growing at a CAGR of 17%. With digital payments, neobanking, and lending platforms reshaping how people manage money, businesses that don’t invest in custom fintech solutions risk falling behind competitors who already have.

With 6+ years of experience and 200+ successful projects delivered, our fintech web development company helped startups and enterprises build secure, scalable fintech platforms from the ground up. We understand what it takes to navigate the technical complexity, regulatory requirements, and user experience challenges that come with fintech development.

In this complete guide, we walk you through everything you need to know — from defining your fintech niche and choosing the right tech stack to implementing security best practices, managing compliance, and planning your launch strategy. Let’s get started.

What is a Fintech Web App?

A fintech web app is a browser-based software application that delivers financial services digitally.

Unlike traditional banking software that relies on legacy infrastructure and in-branch processes, fintech web apps are built to be fast, user-friendly, and accessible from any device with an internet connection.

These web applications handle sensitive financial operations such as payments processing, account management, investment tracking, lending, and insurance — all while meeting strict regulatory and security standards.

Their ability to combine the reliability of financial systems with the speed and usability of modern web technology.

Some well-known examples of fintech web apps include Stripe Dashboard for payment management, Robinhood for stock trading, Wise for international money transfers, and Plaid for bank account aggregation. Each of these platforms started by solving a specific financial pain point and scaled from there.

Understanding what a fintech web app is gives you the foundation but to build one successfully, you first need to identify which type of fintech product aligns with your business goals.

7 Common Types of Fintech Web Applications You Can Build

Before you start building, it’s essential to understand which category your fintech app falls into. The type of app you’re building directly impacts your technology choices, regulatory requirements, development timeline, and the third-party integrations you’ll need.

Here are the seven most common types of fintech web applications we see in the market today.

1. Digital payment platforms

These apps facilitate peer-to-peer transfers, merchant payments, and invoicing. Think PayPal, Venmo, and Razorpay. They require robust payment gateway integrations, PCI DSS compliance, and real-time transaction processing capabilities. Payment platforms typically generate revenue through transaction fees, making high uptime and low latency critical to profitability.

2. Neobanking applications

Digital-first banking platforms that offer checking accounts, debit cards, and savings tools without a physical branch. Chime and Revolut are popular examples. These typically require partnerships with licensed banks or BaaS providers, since obtaining a full banking license independently can take years and cost millions.

3. Lending and credit platforms

Apps that enable personal loans, business financing, or Buy Now Pay Later (BNPL) services. They involve credit scoring algorithms, KYC verification, and regulatory compliance around lending practices. The technical challenge here lies in building accurate risk assessment models that balance approval rates with default risk.

4. Wealth management and investment apps

Robo-advisors, portfolio trackers, and stock trading platforms fall into this category. They need real-time market data feeds, secure transaction handling, and compliance with securities regulations like those enforced by the SEC or FCA. Latency-sensitive operations like trade execution demand particularly robust backend infrastructure.

5. Insurance technology (Insurtech)

Platforms that digitize policy management, claims processing, and underwriting. They integrate with legacy insurance systems and require specialized compliance frameworks. The key development challenge is modernizing traditionally paper-heavy workflows into seamless digital experiences.

6. Personal finance management tools

Budgeting apps, expense trackers, and financial planning tools that aggregate data from multiple bank accounts. Plaid and Yodlee integrations are common here. These apps succeed when they turn raw financial data into actionable insights that help users make better money decisions.

7. RegTech and compliance platforms

Applications that help other financial institutions manage regulatory compliance, fraud detection, and reporting obligations. This is a rapidly growing niche as regulations become increasingly complex and financial institutions look to automate compliance workflows.

Now that you know the different types of fintech web apps, the next logical question is, why should you invest in building a custom one instead of using an existing solution?

Why Build a Fintech Web App? 5 Key Business Benefits

You might wonder — why invest in a custom fintech web app instead of using off-the-shelf solutions? The answer comes down to control, differentiation, and long-term scalability. Here are the five key advantages that make custom fintech development worth the investment.

1. Competitive differentiation through custom fintech functionality

A custom-built platform lets you deliver unique features and user experiences that off-the-shelf tools simply can’t match. In a crowded market, your product’s unique capabilities become your strongest moat against competitors.

2. Direct control over compliance and regulatory adaptability

You own your compliance infrastructure, making it easier to adapt to changing regulations across different markets. When a new regulation drops, you can update your platform on your timeline and completely remove waiting for a third-party vendor to roll out changes.

3. Scalability aligned with business growth and transaction volume

Custom architecture allows you to scale specific components independently as your user base grows. If your payment processing needs to handle 10x more volume but your KYC module doesn’t, you can scale just the parts that need it.

4. User experience optimization across fintech customer journeys

You can design every touchpoint of the customer journey to reduce friction and build trust. Generic fintech solutions force you into predefined workflows that may not align with how your users actually behave.

5. Higher revenue potential through flexible monetization models

Direct control over payment flows, fee structures, and monetization models means better margins. You’re not paying a percentage to a platform provider on every transaction.

According to McKinsey, fintech companies that invest in custom technology platforms see 20-30% higher customer retention rates compared to those relying on generic solutions. That retention advantage compounds over time, making custom development one of the highest-ROI investments a fintech company can make.

Looking to Build a Secure Fintech Web Application?

Monocubed has helped startups and enterprises launch compliant, scalable fintech platforms. Let’s discuss your project requirements.

With the business case established, let’s move into the practical side and learn about the step-by-step web app development process for actually building your fintech web app.

How to Build a Fintech Web App: A 10-Step Development Process

Now that you understand what fintech web apps are, the different types available, and why building a custom platform makes strategic sense, let’s dive into the actual development lifecycle.

At Monocubed, we follow a systematic 10-step approach to ensure every fintech project meets both business objectives and regulatory standards.

Step 1: Define your fintech niche and validate the business idea

Every successful fintech product starts with a clearly defined problem. Before writing a single line of code, get crystal clear on what problem you’re solving and who you’re solving it for.

Start by answering these critical questions:

- Who is your target user — consumers, small businesses, or enterprises?

- What existing pain point are you addressing, and how are users currently solving it?

- What is your revenue model — subscription, transaction fees, freemium, or a hybrid?

- Who are your direct competitors, and what’s your unique differentiator?

Don’t stop at answers on paper. Go and talk to potential users, study competitor products firsthand, and map out the user journey from first visit to completed transaction.

Best Practice: Conduct market research and user interviews before committing to development. Validate your concept with a clickable prototype and test it with 15–20 real users. This step alone can save you months of wasted development effort and reveal blind spots you wouldn’t find otherwise.

With your niche validated, the next critical step is understanding the regulatory environment your product will operate in.

Step 2: Understand regulatory requirements and compliance obligations

Fintech is one of the most heavily regulated sectors in tech. Ignoring compliance can result in hefty fines, lawsuits, or a complete shutdown of your platform. According to CCN.com, global regulatory fines in the financial sector exceeded $5.8 billion in 2024 alone.

Here’s a breakdown of the key regulations you need to be aware of based on your target market:

| Region | Regulation | Focus Area |

|---|---|---|

| USA | PCI DSS | Payment card data security |

| USA | SOX, Dodd-Frank | Financial reporting and consumer protection |

| EU | PSD2 | Open banking and payment services |

| EU | GDPR | Data privacy and user protection |

| Global | AML / KYC | Anti-money laundering and identity verification |

| India | RBI Guidelines | Digital lending, payments, and data localization |

The regulatory landscape isn’t static either. New rules around cryptocurrency, open banking, and AI-driven financial services are emerging regularly. Your platform needs to be flexible enough to adapt as these regulations evolve.

We recommend consulting a fintech compliance attorney early in your journey — ideally before you finalize your feature set. You’ll also need to decide whether to obtain your own financial licenses or partner with a Banking-as-a-Service (BaaS) provider like Unit, Column, or Treasury Prime to operate under their existing licenses.

Once you have a clear picture of your compliance obligations, you’re ready to make informed decisions about your technology stack.

Step 3: Choose a secure and scalable technology stack

Your technology choices should prioritize security, reliability, and scalability — in that order. Fintech isn’t the place for experimental frameworks or cutting-edge libraries with limited community support. You need battle-tested web technologies that can handle sensitive financial data without fail.

The right tech stack also depends on the type of fintech app you’re building (as we discussed earlier), the size of your development team, and whether you need real-time processing, complex data analytics, or heavy third-party integrations.

Here’s the tech stack we recommend for most fintech web applications:

| Layer | Recommended Technologies | Why It Works |

|---|---|---|

| Frontend | React, Next.js, TypeScript | Component-based UI, type safety for financial logic, server-side rendering for performance |

| Backend | Node.js (NestJS), Python (FastAPI), Java (Spring Boot) | Proven ecosystem, strong security libraries, enterprise-grade reliability |

| Database | PostgreSQL, Redis, TimescaleDB | ACID compliance for financial data, high-speed caching, time-series analytics |

| Infrastructure | AWS / GCP, Docker, Kubernetes, Terraform | Compliance certifications (SOC 2, PCI DSS), reproducible and scalable deployments |

Important: Always use TypeScript over plain JavaScript for fintech applications. Type safety dramatically reduces bugs in financial calculations, payment flows, and data transformations — areas where even a minor error can cost real money.

Pro Tip: Don’t choose a tech stack based on developer hype. Choose based on the maturity of security libraries, availability of compliance tooling, and the long-term talent pool in your region. A slightly “boring” stack that’s well-supported will outperform a trendy one every time in fintech.

With your technology stack selected, the next step is designing a web application architecture that brings it all together securely and at scale.

Step 4: Design a secure and scalable application architecture

Your web app architecture is the foundation everything else rests on. A poorly designed architecture leads to security vulnerabilities, performance bottlenecks, and maintenance nightmares that compound as your user base grows. Getting this right from the start is far cheaper than refactoring later.

Here are the key architectural principles to follow for fintech projects:

- Event-driven design: Use message queues like Kafka or RabbitMQ for transaction processing. This ensures reliability, auditability, and the ability to handle high transaction volumes without losing data even during traffic spikes.

- Idempotent APIs: Every payment endpoint must be idempotent to prevent duplicate charges. If a user clicks “Pay” twice due to a slow connection, or a webhook fires multiple times, they should only be charged once. Implement this using unique idempotency keys on every request.

- Double-entry bookkeeping: Every financial transaction must have a corresponding debit and credit entry that balances out. This isn’t just good practice — it’s the accounting standard that auditors and regulators expect. Skipping this creates reconciliation nightmares later.

- Immutable audit logs: Never delete or update financial records. Always append new entries. This creates a complete, tamper-proof audit trail that satisfies compliance requirements and simplifies dispute resolution.

- CQRS pattern: Separate your read and write models for transaction-heavy systems. This improves query performance for dashboards and reports without impacting the speed of write operations like payment processing.

For most fintech startups, we recommend starting with a modular monolith rather than jumping straight into microservices. It’s simpler to build, easier to debug, and you can extract individual services later as your product scales and the boundaries between domains become clearer.

A solid application architecture means nothing if it isn’t secured properly. Let’s look at how to build security into every layer of your fintech application.

Step 5:Implement security across authentication, data, and infrastructure

In fintech, a security breach not just costs money but also destroys trust. And trust is the single most valuable asset your fintech platform has. Here’s how to build security into every layer of your application:

Authentication and access control:

- Implement multi-factor authentication (MFA) for all user accounts — SMS-based 2FA at minimum, with authenticator app or biometric options for higher-security tiers

- Use OAuth 2.0 / OpenID Connect for secure, standards-based authentication flows

- Apply role-based access control (RBAC) for internal tools and admin panels to ensure employees only access data they need

- Use short-lived JWT tokens (15-minute expiry) with secure refresh token rotation to minimize the window of exposure if tokens are compromised

Data protection:

- Encrypt all data at rest (AES-256) and in transit (TLS 1.3) — no exceptions

- Never store raw credit card numbers — use tokenization through Stripe, Adyen, or a PCI-compliant vault to keep card data off your servers entirely

- Hash sensitive data like passwords and PINs using bcrypt or Argon2 with appropriate work factors

- Implement data masking in logs and non-production environments so sensitive information never appears in plain text outside of production

Application-level security:

- Run SAST (Static Application Security Testing) in your CI/CD pipeline to catch vulnerabilities before code reaches production

- Conduct regular penetration testing by third-party security firms — quarterly for critical systems, annually at minimum

- Implement rate limiting and brute-force protection on all public-facing endpoints, especially login and payment APIs

- Set up intrusion detection and monitoring using tools like AWS GuardDuty, Datadog Security, or CrowdStrike to detect threats in real time

Pro Tip: Security audits shouldn’t be a one-time event. The threat landscape evolves constantly. Schedule quarterly security reviews and annual penetration tests to stay ahead of evolving threats. Also consider running a bug bounty program once your platform is public and ethical hackers can find vulnerabilities your internal team might miss.

With a secure foundation in place, the next step is connecting your app to the financial ecosystem through third-party API integrations.

Step 6:Integrate financial APIs and third-party service providers

No fintech app exists in isolation. Regardless of how well you build your core platform, you’ll rely on third-party services for critical financial operations like payments, identity verification, and account aggregation. Choosing the right partners and integrating with them properly can make or break your product’s reliability.

Here are the most common integrations you’ll need, along with the top providers in each category:

| Function | Top Providers | Use Case |

|---|---|---|

| Payments | Stripe, Adyen, PayPal, Razorpay | Processing card payments, bank transfers, and disbursements |

| Banking-as-a-Service | Unit, Column, Treasury Prime | Issuing bank accounts, debit cards, and managing held funds |

| KYC / Identity | Onfido, Jumio, Plaid Identity | Verifying user identity documents and preventing fraud |

| Account Aggregation | Plaid, Yodlee, MX, TrueLayer | Connecting and reading external bank account data |

| Credit Scoring | Experian, TransUnion, Nova Credit | Assessing borrower risk for lending decisions |

| Card Issuing | Marqeta, Lithic, Stripe Issuing | Creating and managing virtual or physical debit/credit cards |

| Fraud Detection | Sardine, Sift, Featurespace | Real-time fraud prevention and transaction risk scoring |

Each of these integrations, including payment integration introduces an external dependency into your system. If Plaid goes down, your users can’t link their bank accounts. If Stripe has latency issues, your checkout flow suffers. Plan for these scenarios from the start.

Best Practice: Always build an abstraction layer around third-party APIs. This way, if a provider changes their API, increases pricing, or experiences downtime, you can swap them out without rewriting your core application logic. Also implement webhook retry mechanisms with dead-letter queues so you never lose critical event data when third-party callbacks fail.

Now that your backend infrastructure and integrations are in place, it’s time to focus on the layer your users actually interact with the user experience.

Step 7: Design a user experience that builds trust and usability

Your users are trusting you with their money. Every screen, every interaction, and every notification needs to reinforce that trust. In fintech, poor UX makes them question whether their money is safe. And once that doubt sets in, they leave.

Here’s what to prioritize in your fintech UX:

- Onboarding flow: Keep it short and frictionless. Use progressive disclosure to collect only what’s legally required upfront. Nobody wants to fill out a 15-field form before seeing your dashboard. Break KYC steps into digestible stages with clear progress indicators so users know exactly where they are.

- Dashboard design: Show balances, recent transactions, and quick actions front and center. Users should see the information they need within seconds of logging in. Avoid information overload — surface the most important data first and let users drill deeper when they want to.

- Transaction history: Provide robust search, filtering by date and category, and export options (CSV, PDF). Financial data needs to be easy to find and reference. Users often need to look up specific transactions for expense reports, tax filing, or dispute resolution.

- Real-time notifications: Alert users instantly for transactions, low balances, suspicious activity, and important account updates. Notification preferences should be customizable — some users want alerts for every transaction, while others only want to know about large or unusual activity.

- Accessibility: Follow WCAG 2.1 AA standards. Financial tools must be usable by everyone, including users with visual, motor, or cognitive disabilities. This is a legal requirement.

Don’t forget trust signals like display security badges, encryption indicators, and compliance certifications prominently. Transparent fee disclosures and responsive customer support (live chat, in-app help center) also go a long way in building the user confidence that keeps people coming back.

A great user experience means nothing if the underlying system has bugs. With the frontend designed, let’s make sure everything works flawlessly through expert web design services.

Step 8: Build a comprehensive testing strategy for fintech systems

Financial applications demand zero tolerance for bugs when it comes to money movement and balance calculations. A single decimal error in a transaction, a missed edge case in currency conversion, or a race condition in concurrent payments can lead to real financial losses — and real regulatory consequences.

Here’s the testing framework we implement for every fintech project at Monocubed:

- Unit tests: Cover business logic, financial calculations, rounding rules, currency conversion edge cases, and boundary conditions. Aim for 90%+ coverage on all financial modules.

- Integration tests: Validate API endpoints, database operations, and mocked third-party services. Test the full request-response cycle including error handling and timeout scenarios.

- End-to-end tests: Test complete user flows from signup through KYC verification to funding an account and completing a transaction. These tests should run against a staging environment that mirrors production.

- Load tests: Simulate peak traffic scenarios like payday spikes, tax deadline rushes, or market volatility events. Use tools like k6, Locust, or Artillery to identify performance bottlenecks before they affect real users.

- Security tests: Run OWASP Top 10 vulnerability scans, dependency audits, and penetration tests. Automate what you can in CI/CD, and supplement with manual testing by security specialists.

- Compliance tests: Validate that regulatory rules like KYC thresholds, transaction limits, reporting triggers are enforced correctly across all user flows and edge cases.

Important: Never use floating-point arithmetic for money calculations. Floating-point numbers can’t accurately represent decimal values like $0.10, leading to rounding errors that accumulate over thousands of transactions. Use dedicated libraries like dinero.js (JavaScript), Decimal (Python), or BigDecimal (Java) to handle currency values with proper precision.

Testing ensures your app works correctly before launch but what about after? Let’s look at how to maintain visibility into your system once it’s live and processing real money.

Step 9: Set up monitoring and observability for live fintech operations

Once your app is live, you need complete visibility into every transaction and system event. In fintech, you can’t afford to discover problems after your users do. A payment failure that goes undetected for even 30 minutes can affect hundreds of users and trigger a wave of support tickets and chargeback disputes.

Here’s the observability stack we recommend:

- Logging: Structured JSON logs with correlation IDs using ELK Stack, Datadog, or Grafana Loki. Every request should carry a unique trace ID that follows it through every service, making it easy to reconstruct the full journey of any transaction.

- Metrics: Track transaction success rates, latency percentiles (p50, p95, p99), error rates, and throughput with Prometheus and Grafana. Set up dashboards that give your team an at-a-glance view of system health.

- Distributed tracing: Trace individual requests across services using Jaeger or OpenTelemetry. When a payment takes 8 seconds instead of the usual 200ms, tracing tells you exactly which service or database query caused the delay.

- Alerting: Configure real-time alerts through PagerDuty or Opsgenie for critical issues. Define alert thresholds based on your SLAs — for example, alert if payment success rate drops below 99.5% or if p95 latency exceeds 2 seconds.

Beyond the tooling, establish clear on-call rotations and incident response playbooks so your team knows exactly what to do when alerts fire. Document escalation paths, communication templates, and rollback procedures in advance.

You should actively monitor transaction success and failure rates, unusual activity patterns that could indicate fraud, third-party API response times, database connection pool utilization, and user-facing error rates. Set up automated alerts for any metric that falls outside normal thresholds.

With monitoring in place, you’re almost ready for launch. The final step is planning a controlled rollout and a scaling strategy that grows with your user base.

Step 10: Plan a controlled launch and long-term scaling strategy

With development, testing, and monitoring complete, it’s time to plan a controlled, strategic launch. Rushing to market without a launch plan is one of the most common mistakes we see fintech startups make and it’s one of the most expensive to recover from.

Pre-launch checklist:

- Security audit and penetration test completed by an independent third party

- Compliance review and legal sign-off obtained for all target markets

- KYC/AML flows tested end-to-end with real identity providers in sandbox and production

- Load testing passed for 2-3x your expected peak traffic

- Disaster recovery and backup procedures documented, tested, and verified

- Incident response playbook prepared with clear escalation paths

- Customer support channels established, staffed, and trained on common issues

Consider a phased launch — start with a private beta or invite-only access for a small group of users. This lets you validate your systems under real-world conditions, gather early feedback, and fix issues before they impact a larger audience. Many successful fintech companies, including Revolut and Chime, used this exact approach.

Scaling considerations for growth:

- Use horizontal scaling to add more instances rather than upgrading server sizes — this provides better fault tolerance and cost efficiency

- Implement database read replicas for analytics, reporting queries, and dashboard loads that don’t need real-time write access

- Deploy a CDN for static assets and configure edge caching where appropriate to reduce latency for global users

- Plan for multi-region deployment if you serve users across different geographies — data residency laws may also require this

- Invest in automated CI/CD pipelines to ship updates confidently and frequently without manual deployment steps that introduce human error

Need Help Building Your Fintech Web App?

From architecture design to post-launch support, Monocubed delivers end-to-end fintech development services. Let us handle the technical complexity while you focus on your business.

Before planning your fintech platform, it is essential to understand the investment required and the factors that influence overall web app development costs.

How Much Does it Cost to Build a Fintech Web App?

Building a fintech web app typically costs between $40,000 and $500,000+, depending on platform complexity, feature set, compliance requirements, and third-party integrations.

With the web application development process understood, the next practical question most founders and product managers ask is — how much will it actually cost? The honest answer is that it depends on the complexity, features, compliance requirements, and the number of third-party integrations your platform needs.

Here’s a general cost breakdown based on our project experience across 200+ engagements:

| App Complexity | Features Included | Estimated Cost Range | Timeline |

|---|---|---|---|

| Basic MVP | Core features, basic KYC, single payment method, one currency | $40,000 – $80,000 | 3–4 months |

| Mid-Level Platform | Full KYC/AML, multiple payment methods, analytics dashboard, multi-currency support | $80,000 – $200,000 | 5–8 months |

| Enterprise-Grade | Advanced fraud detection, multi-region deployment, custom integrations, white-label capabilities | $200,000 – $500,000+ | 8–14 months |

These estimates include UI/UX design, frontend and backend development, testing, and initial deployment. They do not include ongoing web app maintenance (typically 15-20% of initial build cost per year), third-party API subscription fees, or regulatory licensing costs, which vary significantly by jurisdiction.

Several factors can push web application development costs higher like complex regulatory requirements across multiple markets, real-time data processing needs, advanced AI-driven features like fraud detection or credit scoring, and the need for native mobile apps alongside the web platform.

Pro Tip: Start with a focused MVP that solves one core problem well. Validate your product-market fit with real users, then invest in additional features and scaling. This approach reduces financial risk and helps you iterate based on actual user feedback rather than assumptions.

Understanding costs is important, but so is knowing the obstacles you might face along the way. You can use the web app cost calculator to calculate the true cost of the web application development for your fintech business.

Let’s look at the most common challenges in fintech web development and how to overcome them. Before hiring one of the top web app development firms make sure to

6 Common Challenges in Fintech Web App Development and How to Overcome Them

Building a fintech app isn’t without its hurdles. Being aware of these challenges upfront helps you plan for them rather than react to them. Here are the challenges we see most frequently across our fintech projects and the practical strategies to address them.

1. Navigating complex regulations

Financial regulations differ across countries, states, and financial service categories. A platform compliant in one region may violate regulatory requirements in another, increasing legal risks and compliance costs.

Solution:

Build compliance-ready architectures with adaptable workflows, regulatory monitoring processes, and jurisdiction-specific compliance modules that can evolve with changing regulations without requiring full platform redevelopment. Monocubed integrates PCI DSS, KYC/AML, and regional data privacy compliance frameworks during early development.

2. Ensuring data security at scale

As fintech platforms grow, expanding user bases increase data exposure, API endpoints, and potential cybersecurity vulnerabilities. Security gaps can lead to financial loss, legal penalties, and reputation damage.

Solution:

Implement multi-layer security architectures with encryption, role-based access controls, continuous threat monitoring, and scalable authentication frameworks designed to grow alongside transaction volumes.

Monocubed follows a security-first development model, embedding encryption protocols, advanced authentication mechanisms, and real-time monitoring into fintech platforms.

3. Building user trust

Users hesitate to trust new fintech platforms with sensitive financial data, especially when established financial institutions already dominate the market.

Solution:

Strengthen user confidence through transparent workflows, visible security features, third-party certifications, and responsive support systems that reinforce platform reliability and credibility. Monocubed designs fintech interfaces that emphasize secure onboarding, compliance-driven workflows, and trust-focused user experience design, helping businesses establish credibility and improve customer adoption rates.

4. Managing third-party dependencies

Fintech platforms depend on multiple external services for payments, banking data, fraud detection, and identity verification. Service outages, API changes, or pricing updates can disrupt platform functionality.

Solution:

Develop integration abstraction layers, implement fallback service strategies, and continuously monitor third-party service performance to ensure operational continuity. Monocubed builds resilient fintech ecosystems with multi-provider integration strategies and robust API management systems that maintain platform stability even during third-party disruptions.

5. Handling financial precision

Calculation errors caused by currency conversions, timezone differences, rounding inconsistencies, or floating-point inaccuracies can lead to financial discrepancies and compliance risks.

Solution:

Use standardized decimal processing systems, consistent timestamp protocols, strict rounding logic, and comprehensive financial edge-case testing to maintain transactional accuracy.

6. Scaling for peak loads

Fintech platforms often experience sudden traffic spikes during tax seasons, market volatility, or promotional campaigns, which can lead to system slowdowns or transaction failures.

Solution:

Adopt cloud-native infrastructure with auto-scaling, load balancing, and performance monitoring to maintain platform responsiveness during high-demand periods.

Being prepared for these challenges is half the battle. The other half is having the right development partner to help you navigate them.

| Facing Challenges With Your Fintech Project?Our team has helped 200+ clients overcome complex technical and compliance challenges in fintech development. Let’s talk about how we can help you move forward. Book Your Free Consultation With Us |

Build Your a Future-Ready Fintech Web App With Monocubed

Developing a fintech web application is far more complex than traditional software development. It requires navigating evolving financial regulations, implementing security-first infrastructure, and building scalable architectures that support real-time transactions, auditability, and long-term platform stability.

The most successful fintech platforms begin with clearly defined problem statements, early user validation, and a carefully selected technology stack. Integrating compliance, data security, and transaction accuracy into every development phase ensures reliability and builds long-term user trust.

Whether you are launching a payment solution, neobanking platform, lending marketplace, or investment dashboard, these fundamentals remain critical for sustainable growth.

Monocubed brings specialized fintech development expertise and leverages its web application development services to build scalable, reliable apps across payments, banking, lending, and investment ecosystems.

From initial architecture planning and compliance implementation to post-launch optimization and platform scaling, our web development team supports businesses throughout the entire development lifecycle. If you are ready to transform your fintech idea into a secure, scalable, and market-ready solution, we are here to help you build it with confidence.

Want to Build a Fintech App With Latest Technologies and Trends?

Our fintech experts help you design, develop, and launch high-performance platforms built for security, compliance, and long-term growth.

Frequently Asked Questions

-

How long does it take to build a fintech web app?

It depends on the complexity and scope. A basic MVP with core features, a single payment method, and basic KYC can be built in 3–4 months. A mid-level platform with full compliance, multi-currency support, and analytics typically takes 5–8 months. A full-featured enterprise platform with advanced fraud detection and multi-region deployment may take 8–14 months. Factors like regulatory requirements, the number of third-party integrations, and custom feature sets all impact the timeline.

-

What tech stack is best for fintech development?

We recommend React or Next.js for the frontend, Node.js (NestJS) or Python (FastAPI) for the backend, and PostgreSQL as the primary database. TypeScript should be used throughout for type safety in financial calculations. For high-performance requirements, Java (Spring Boot) or Go are excellent backend alternatives. The right choice depends on your specific requirements, team expertise, and the type of fintech app you’re building.

-

How much does fintech app development cost?

Costs typically range from $40,000 to $500,000+ depending on the scope and complexity. A simple MVP starts around $40,000–$80,000, mid-level platforms with full compliance and multi-currency support range from $80,000–$200,000, and enterprise-grade platforms with advanced fraud detection and multi-region support can exceed $200,000. These estimates cover design, development, testing, and deployment but not ongoing maintenance or third-party fees.

-

What regulations do I need to comply with?

At a minimum, you’ll need to comply with PCI DSS for payment card data security, KYC/AML regulations for identity verification and anti-money laundering, and GDPR if you serve European users. In the US, depending on your services, you may also need to comply with SOX, Dodd-Frank, and state-level money transmitter laws. Specific requirements vary based on your location, target market, and the type of financial services you provide. We strongly recommend consulting a fintech compliance attorney before you begin development.

-

Can I start with an MVP and scale later?

Absolutely — and in fact, we recommend this approach for most fintech startups. Start with a focused MVP that addresses one core user problem, validate product-market fit with real users, and then invest in additional features and scaling. The key is building your initial architecture with scalability in mind so you don’t need a complete rewrite later. Design your database schema, API contracts, and service boundaries to accommodate growth from the start.

-

Do I need a banking license to build a fintech app?

Not necessarily. Many fintech startups partner with Banking-as-a-Service providers like Unit, Column, or Treasury Prime, which allow you to offer banking services under their existing licenses. This approach gets you to market faster and at a fraction of the cost of obtaining your own charter. Whether you need your own license depends on the specific financial services you offer, the jurisdictions you operate in, and your long-term strategic goals.

-

How do I ensure my fintech app is secure?

Security in fintech requires a multi-layered approach. Implement multi-factor authentication, encrypt all data at rest and in transit, use tokenization for payment card data, and apply role-based access control. Run regular penetration tests, integrate SAST tools into your CI/CD pipeline, and set up real-time intrusion detection. Compliance with PCI DSS and SOC 2 standards provides a strong security baseline. Most importantly, treat security as an ongoing process, not a one-time checkbox.

By Yuvrajsinh Vaghela

By Yuvrajsinh Vaghela