Contents

Fintech website development cost ranges from $25,000 to $500,000 or more, depending on the platform type, feature complexity, regulatory compliance requirements, and integration depth with banking systems and payment processors.

The wide price gap between a basic payment gateway interface and an enterprise digital banking platform with AI-powered fraud detection and multi-system interoperability makes budgeting difficult without a clear understanding of what drives these numbers.

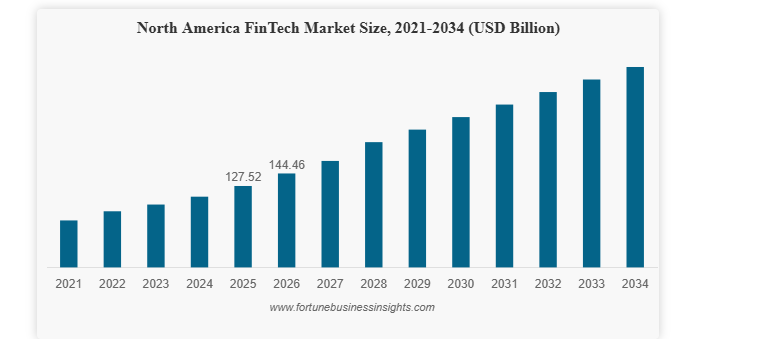

The growing demand for fintech platforms is accelerating investment in secure and scalable digital financial solutions. The global fintech market is projected to surpass USD 1,760.18 billion by 2034, while over 65% of consumers now prefer digital financial services over traditional banking channels. ( Source: Fortune Business Insights)

At the same time, regulatory compliance costs and security infrastructure remain among the top factors influencing fintech development budgets.

This guide is built on Monocubed’s experience delivering 200+ custom web solutions across fintech, healthcare, and enterprise industries. With our experience and years of knowledge, we have created this guide that breaks down the fintech website development cost, explains the factors that influence pricing, and provides practical insights to help you plan your budget and make confident investment decisions for your fintech project.

What Is the Average Cost of Fintech Website Development?

The average fintech website development cost falls between $25,000 and $500,000, with most mid-range projects landing in the $75,000 to $250,000 range.

These figures reflect custom development with PCI DSS-compliant architecture, secure cloud infrastructure, and at least one major banking or payment system integration. The final cost depends entirely on your project scope, and no two fintech platforms carry the same price tag.

According to Statista, the global fintech market reached $340 billion in 2024 and is growing at approximately 25% annually. This growth reflects the accelerating demand for digital banking platforms, payment processing systems, and investment management tools.

Organizations investing in fintech web development today are positioning themselves within a market where digital financial infrastructure is becoming the standard, not the exception.

Cost comparison across fintech platform types and use cases

| Platform Type | Cost Range | Timeline | Key Features |

|---|---|---|---|

| Basic Fintech Website | $25,000 – $75,000 | 2 – 4 months | Payment gateway integration, user authentication, basic dashboards, PCI DSS-compliant forms, KYC verification |

| Mid-Range Fintech Platform | $75,000 – $200,000 | 4 – 8 months | Multi-payment processing, real-time transactions, open banking API integration, compliance automation, analytics dashboards |

| Enterprise Fintech Platform | $200,000 – $500,000+ | 8 – 14 months | AI-powered fraud detection, multi-currency support, full regulatory compliance suite, multi-tenant architecture, advanced analytics |

| Lending Platform | $80,000 – $250,000 | 4 – 9 months | Credit scoring algorithms, loan origination workflows, automated underwriting, document verification, repayment management |

| Investment and Wealth Management Platform | $120,000 – $350,000 | 6 – 12 months | Real-time market data feeds, portfolio management, robo-advisory features, SEC compliance, trade execution |

These ranges cover website development costs. Hosting, maintenance, compliance updates, and third-party licensing add to the total cost of ownership, which we address in detail later in this guide.

Get a Tailored Fintech Website Development Cost Estimate

Every fintech project has unique compliance needs, integration requirements, and transaction processing workflows. Share your project scope with our team and receive a transparent, detailed cost breakdown.

Key Factors That Influence Fintech Website Development Cost

Fintech website development pricing is not arbitrary. Understanding the factors below gives you control over your budget by making informed decisions about scope, features, compliance, and team selection. Each factor directly impacts how much you pay and the value you receive.

1. Project scope and functional complexity as primary cost drivers

The primary cost driver is the overall scope and complexity of your fintech platform. A simple payment processing interface requires a fundamentally different architecture than a multi-currency digital banking platform with real-time transaction processing, AI-powered fraud detection, and regulatory reporting dashboards.

| Platform Complexity | Project Scope & Features | Estimated Cost Range | Typical Timeline |

|---|---|---|---|

| Simple Fintech Websites | Limited features, single user role, basic financial functionality | $25,000 – $75,000 | 2 – 4 months |

| Medium-Complexity Platforms | Banking API integrations, multi-user roles, expanded financial workflows | $75,000 – $200,000 | 4 – 8 months |

| Enterprise Fintech Platforms | Advanced functionality, AI-driven features, high scalability, multi-system integrations | $200,000+ | 8 – 14 months |

The complexity of financial logic like transaction reconciliation, multi-party settlements, and real-time balance calculations adds development effort that does not exist in standard website development.

2. Feature depth and third-party integrations impacting fintech pricing

Every feature added to a fintech platform carries its own design, development, testing, and compliance validation cost. Here are typical cost ranges for common fintech features:

| Feature | Cost Range |

|---|---|

| User registration with KYC/AML verification | $5,000 – $20,000 |

| Multi-factor authentication and role-based access | $3,000 – $10,000 |

| Payment gateway integration (Stripe, Adyen, PayPal) | $4,000 – $15,000 |

| Open banking API integration (Plaid, Yodlee) | $8,000 – $30,000 |

| Real-time transaction processing engine | $10,000 – $40,000 |

| Multi-currency support with real-time conversion | $6,000 – $25,000 |

| Financial dashboard with data visualization | $8,000 – $30,000 |

| Credit scoring and risk assessment module | $15,000 – $50,000 |

| Automated lending and loan origination workflow | $12,000 – $45,000 |

| AI-powered fraud detection system | $15,000 – $60,000 |

| Regulatory reporting and compliance automation | $10,000 – $35,000 |

| Notification system (SMS, email, push) | $2,000 – $8,000 |

Payment processing integration and open banking connectivity are consistently the most significant cost multipliers. Connecting with banking networks through APIs like Plaid, Yodlee, or MX requires working with standardized financial data exchange protocols, which demands specialized fintech development expertise.

3. UI and UX design requirements for trust-driven fintech platforms

Fintech platforms must earn user trust before users hand over sensitive financial data. The design approach you choose affects both website design cost and user adoption.

- Template-based design ($2,000 – $8,000): Pre-built fintech templates customized with your branding. Limited customization and may not meet the trust signals financial users expect.

- Semi-custom design ($8,000 – $25,000): Modified templates with custom financial workflows and branding. Good balance of cost and usability for mid-range platforms.

- Fully custom design ($25,000 – $80,000+): Built from scratch with user research, wireframing, prototyping, and accessibility testing. Delivers the highest conversion and trust rates.

Based on our experience designing websites, investing in user research and trust-building design elements during the design phase reduces post-launch website redesign costs and directly improves user engagement.

4. Technology stack selection and its effect on development and maintenance costs

The choice between React.js, Angular, or Vue.js for frontend and Node.js, Python Django, Java Spring Boot, or .NET for backend affects development speed, scalability, and long-term website maintenance costs. Fintech platforms benefit from technologies with strong financial ecosystem support, real-time processing capabilities, and mature security libraries.

Choosing a technology stack that natively supports financial data standards and real-time processing prevents expensive re-architecture later. For example, selecting PostgreSQL for its strict ACID compliance for financial transactions and deploying on SOC 2-certified cloud platforms (AWS, Azure, GCP) from day one avoids migration costs that can run $20,000 to $50,000 or more.

Teams experienced in React.js development and Node.js development build fintech platforms faster because these frameworks are well-suited for real-time data handling and API-heavy architectures.

5. Development team expertise and geographic location influence on cost

The development team you choose affects both cost and quality. Fintech projects require domain expertise that general-purpose developers often lack, particularly around PCI DSS compliance, open banking standards, and real-time financial transaction architecture.

| Region | Hourly Rate |

|---|---|

| North America (USA/Canada) | $100 – $250 |

| Western Europe | $70 – $150 |

| Eastern Europe | $40 – $80 |

| South Asia | $20 – $50 |

A lower hourly rate does not always mean lower total cost. Teams without fintech experience may take longer, produce compliance gaps, and require expensive remediation, making experienced teams more cost-effective despite higher rates.

6. Security, PCI DSS compliance, and regulatory cost considerations

PCI DSS compliance, SOC 2 certification, and regulatory requirements add 20% to 35% to development costs compared to non-financial web applications. This covers AES-256 encryption, tokenization of sensitive data, multi-factor authentication, role-based access controls, comprehensive audit logging, penetration testing, and compliance documentation.

Organizations that also require GDPR compliance, state money transmitter licenses, or SEC/FINRA compliance should budget an additional $10,000 to $50,000 per compliance requirement. You can also learn about the budget you need to prepare for the website security and compliance by checking these security practices.

7. Third-party services, API licensing, and recurring platform expenses

Fintech platforms rely on external services that carry ongoing costs:

- Payment processing (Stripe, Adyen): Transaction fees + $0 – $500/month

- Banking data aggregation (Plaid, Yodlee): $500 – $5,000/month

- KYC/Identity verification (Jumio, Onfido): $500 – $3,000/month

- SMS/WhatsApp notifications (Twilio): $200 – $2,000/month

- Market data feeds (for investment platforms): $1,000 – $10,000/month

- Email services (SendGrid): $50 – $500/month

These costs compound over time and must be factored into your total budget from the planning stage.

While primary website development costs are easier to estimate, many additional expenses emerge during and after deployment. Recognizing these overlooked cost elements is essential for realistic fintech project planning.

5 Hidden and Often Overlooked Costs in Fintech Website Development

The initial development quote rarely captures the full cost of building and operating a fintech platform. These commonly overlooked expenses can add 30% to 50% to your original budget if not planned for.

1. PCI DSS-compliant hosting, cloud infrastructure, and disaster recovery costs

Fintech platforms require PCI DSS-eligible cloud services with encrypted storage, network segmentation, and audit-ready logging. Standard web hosting does not meet these requirements.

- Shared compliant hosting: $300 – $1,000/month (basic platforms with low transaction volume)

- PCI DSS-eligible VPS: $1,000 – $3,000/month (mid-range platforms with moderate traffic)

- Dedicated PCI-compliant cloud (AWS/Azure/GCP): $3,000 – $10,000+/month (enterprise platforms with high availability and redundancy)

- Disaster recovery and backup: $500 – $2,000/month (depending on data volume and recovery time objectives)

2. Ongoing maintenance, security updates, and platform optimization costs

Neglecting maintenance leads to security vulnerabilities, compliance failures, and degraded user experience. Annual maintenance costs typically run 15% to 25% of the original development investment.

- Basic maintenance: $1,500 – $5,000/month (bug fixes, minor updates, monitoring)

- Comprehensive maintenance: $5,000 – $15,000/month (API compatibility updates, compliance patches, performance optimization, feature adjustments, security updates)

Financial platforms operate in an environment where APIs change, regulations evolve, and security threats escalate continuously. A maintenance gap of even a few months can create compliance exposure.

3. Compliance audits, regulatory changes, and certification expenses

Financial regulations evolve continuously. PCI DSS version updates, new state money transmitter requirements, open banking mandates, and data privacy regulations require periodic platform updates and compliance reviews.

- Annual PCI DSS compliance audit: $5,000 – $25,000

- SOC 2 Type II certification: $15,000 – $50,000

- Regulatory update implementation: $5,000 – $30,000/year

- Continuous security monitoring, penetration testing, and fraud prevention costs

Continuous security monitoring is essential to protect financial data, detect threats early, and maintain customer trust. Fintech platforms typically require advanced security infrastructure, including SIEM systems, vulnerability assessments, and real-time threat monitoring.

These investments help prevent data breaches, fraud incidents, and service downtime that can significantly impact business operations.

- Security monitoring and SIEM: $500 – $2,000/month

- Annual penetration testing: $5,000 – $30,000

- DDoS protection: $200 – $1,000/month

- Real-time fraud monitoring tools: $500 – $5,000/month

5. Recurring licensing and subscription costs for fintech integrations

Third-party APIs, banking integration licenses, market data feed subscriptions, and KYC service agreements carry ongoing fees that many organizations underestimate during initial budgeting. Banking data aggregation services alone can cost $500 to $5,000 per month depending on transaction volume and the number of connected institutions.

With recurring integration and infrastructure expenses adding up quickly, optimizing development strategies becomes essential. Let’s explore practical ways to reduce fintech website development costs without sacrificing performance, security, or compliance.

How to Reduce Fintech Website Development Costs Without Compromising Quality

Reducing fintech development costs does not mean cutting corners on PCI DSS compliance or user trust. It means making strategic decisions that focus your investment where it delivers the most value.

1. Minimum viable product approach to reduce initial fintech costs

Launch with essential features like user onboarding, single payment integration, basic transactions, and core compliance. Gather real user feedback before investing in advanced capabilities like AI-powered features, multi-currency support, or complex analytics dashboards. This MVP development approach avoids building features that go unused and focuses your budget on what users actually need first.

2. Discovery and planning to prevent scope creep and budget overruns

Adding features mid-project increases costs through scope changes, rework, and extended timelines. A $10,000 to $15,000 discovery investment can save multiples of that amount during development by documenting every financial workflow, integration requirement, and compliance obligation upfront. Based on our experience delivering 200+ projects, organizations that skip discovery consistently face budget overruns of 30% or more.

3. Strategic use of third-party fintech services to reduce build effort

Use established services for payment processing (Stripe, Adyen), KYC verification (Jumio, Onfido), banking data aggregation (Plaid), and communication (Twilio, SendGrid) instead of building custom. Each integration still requires secure implementation, but third-party services save significant development time compared to building from scratch. Stripe alone can eliminate months of PCI DSS-related development by keeping raw card data off your servers.

4. Selecting cost-efficient and scalable technologies for fintech platforms

elect technology frameworks with strong fintech ecosystem support. React.js or Angular for frontend, Node.js or Python Django for backend, and PostgreSQL for databases work well for fintech web applications. Choosing web technologies that natively support real-time processing and deploy easily on PCI-compliant cloud platforms prevents costly re-architecture later.

5. Phased fintech website development for controlled investment

Instead of building everything at once, plan a phased roadmap that spreads investment over time and delivers value at each stage. Phase 1 might cover core payment features and basic compliance, Phase 2 adds advanced integrations and multi-currency support, and Phase 3 introduces AI-powered fraud detection and analytics capabilities.

6. Open-source frameworks and AI tools for fintech cost optimization

Open-source technologies and established frontend libraries provide robust foundations without licensing fees. Combined with AI-powered development tools that can reduce development timelines by up to 50%, these frameworks significantly reduce development time and cost while maintaining compliance standards.

Even with clearly defined features and development strategies, fintech website costs can differ significantly depending on the development partner you choose.

Why Fintech Website Development Costs Vary Between Vendors

Understanding why one vendor quotes $80,000 and another quotes $300,000 for what appears to be the same project helps you evaluate proposals on total value rather than just the headline number.

1. Fintech domain expertise as a key differentiator in vendor pricing

Fintech-experienced teams understand PCI DSS compliance, open banking standards, and real-time transaction architecture from the beginning. They embed compliance and security into the core system design, preventing costly remediation later.

In contrast, general development teams may build functional platforms that struggle with compliance audits or high transaction volumes.

2. Development process maturity and its impact on delivery cost

Fintech development agencies with structured discovery, agile sprint execution, dedicated QA, and documented compliance workflows deliver more predictable and secure outcomes. Less mature teams may offer lower initial pricing but often introduce risks such as scope creep, missed regulatory requirements, and insufficient security validation.

Monocubed follows a compliance-first development framework with clearly defined sprint planning, testing cycles, and risk assessments to minimize project uncertainty.

3. Fintech industry specialization and reusable development components

Fintech-focused development companies bring pre-built modules, proven integration patterns for major payment processors and banking APIs, and cross-jurisdiction regulatory familiarity. This specialization accelerates development timelines and significantly reduces compliance risks compared to teams learning fintech requirements during project execution.

4. Geographic location and collaboration model impact on total cost

North American agencies charge $100 to $250 per hour compared to $20 to $80 for offshore teams. However, the total cost difference is often smaller than hourly rates suggest because experienced nearshore teams require fewer hours, produce fewer compliance gaps, and communicate more effectively during stakeholder reviews.

Monocubed offers the advantage of North American presence with offices in Canada and USA, providing same-timezone collaboration without the enterprise-agency price premium.

After evaluating development expenses and vendor differences, it’s important to assess whether fintech website development generates meaningful business returns.

Is Fintech Website Development Worth the Investment? ( 4 Ways to Do)

The value of a fintech website extends far beyond the features it delivers. The real question is whether the investment generates returns that justify the cost.

1. Return on investment through revenue growth and operational efficiency

Fintech platforms that deliver strong digital experiences report measurable improvements across multiple areas:

- User acquisition: According to Deloitte, financial institutions with superior digital experiences grow deposits 1.5x faster than competitors with poor digital platforms

- Operational efficiency: Automated financial workflows reduce manual processing time by 40% to 70%, cutting operational costs significantly

- Revenue growth: The global fintech market growing at 25% annually reflects strong user demand for digital financial services

- Customer retention: Platforms with real-time dashboards, instant notifications, and seamless transaction experiences report 25% to 40% higher retention rates compared to traditional financial service providers

2. Scalability advantages of custom fintech platforms

A properly architected fintech platform scales with your business. Adding new financial products, payment methods, geographic markets, and user volume does not require rebuilding the platform. This long-term scalability makes the initial investment more cost-effective than it appears when evaluated over a 3 to 5 year period.

3. Risk reduction through compliance-first fintech architecture

Custom fintech platforms built with PCI DSS-compliant architecture reduce the risk of data breaches, regulatory fines, and compliance failures. According to IBM’s Cost of a Data Breach Report, the average financial sector data breach costs $5.9 million. Investing in security from day one is significantly less expensive than remediation after a breach.

4. Long-term value of custom fintech platforms over off-the-shelf tools

Off-the-shelf financial software carries recurring subscription fees that compound over time and limits your ability to differentiate. A custom fintech platform costs more upfront but eliminates ongoing licensing fees, provides complete ownership of your technology, and allows unlimited customization as your business model evolves.

Get Fintech Website Development Cost Estimation From Monocubed

As a leading website development company, cost estimation is not guesswork or templated pricing — it’s a structured discovery-led process designed specifically for fintech platforms.

We start by analyzing your financial workflows, transaction volume expectations, regulatory exposure (PCI DSS, KYC/AML, regional compliance), and integration requirements with banking APIs, payment processors, and third-party services. This allows us to define a realistic scope before development begins — eliminating budget surprises later.

With 200+ custom web applications delivered, including payment platforms, transaction-heavy systems, and compliance-driven products, our team brings hands-on experience in PCI DSS-compliant architecture, real-time transaction processing, and secure API integrations. Every estimate includes a clear breakdown of development phases, security implementation, compliance effort, and long-term scalability considerations.

If you’re planning to build or scale a fintech solution, working with Monocubed means partnering with a team that understands both financial risk and engineering complexity. Our transparent cost estimates help you plan confidently, launch faster, and build a fintech platform that supports long-term growth without unexpected overruns.

Launch a Future-Ready Fintech Platform Without Budget Surprises

Turn your fintech idea into a secure, scalable, and compliance-ready platform built for real transaction volumes and long-term growth. Monocubed helps you plan, design, and develop fintech solutions with predictable costs and faster time to market

Frequently Asked Questions

-

How long does fintech website development take?

Basic fintech websites take 2 to 4 months, mid-range platforms with banking API integration require 4 to 8 months, and enterprise platforms need 8 to 14 months. Timeline depends on feature complexity, number of integrations, compliance requirements, and team size. Compressed deadlines increase costs because parallel work streams and additional developers are needed.

-

Can I reduce fintech website development costs without sacrificing compliance?

Yes, through strategic planning. Start with an MVP that includes core features, integrate third-party services for payments and KYC instead of building custom, choose tech stacks with strong fintech ecosystem support, and invest in thorough discovery to prevent scope creep. These strategies optimize investment while maintaining full PCI DSS compliance and regulatory adherence.

-

Why do costs vary so much between development agencies?

Agencies factor in fintech domain expertise, PCI DSS compliance capabilities, banking API integration experience, team size, QA standards, and post-launch support. An agency quoting $75,000 may exclude compliance testing, while one quoting $200,000 includes penetration testing, security audits, regulatory documentation, and 90-day maintenance. Always compare proposals on total scope, not headline price.

-

Do I need a custom fintech platform, or is off-the-shelf software enough?

Off-the-shelf solutions work for organizations with standard payment processing and basic financial management needs. Custom development is necessary when your financial workflows require proprietary algorithms, you need deep integration with specific banking partners or payment processors, you serve markets with unique regulatory requirements, or you need multi-product support with custom compliance controls. Custom platforms cost more upfront but deliver better long-term ROI and competitive differentiation.

-

How does PCI DSS compliance affect fintech website development cost?

PCI DSS compliance adds 20% to 35% to development costs compared to non-financial web applications. This covers encryption of cardholder data, network segmentation, multi-factor authentication, access controls, comprehensive audit logging, penetration testing, and compliance documentation. Non-compliance exposes organizations to fines of up to $500,000 per incident and potential loss of the ability to process card payments entirely.

-

What ongoing costs should I budget for after launch?

Budget for PCI-compliant hosting ($1,000 to $10,000+/month), maintenance and updates ($1,500 to $15,000/month), annual compliance audits ($5,000 to $50,000), security monitoring ($500 to $2,000/month), and third-party service fees (variable based on transaction volume). Annual maintenance typically runs 15% to 25% of the original development cost.

-

Can AI reduce fintech website development costs?

AI-powered development tools can accelerate code generation, testing, and quality assurance, reducing timelines by up to 50% for standard features. However, complex banking integrations, PCI DSS compliance architecture, and financial workflow customization still require experienced fintech developers. AI works best as a supplement that optimizes costs without compromising compliance quality.

-

What happens after my fintech platform launches?

All Monocubed projects include 90 days of post-launch maintenance at no additional cost, covering bug fixes, performance tuning, and minor feature adjustments. After the support period, you can engage us on an hourly or dedicated team basis for ongoing development, compliance updates, and feature additions.

By Yuvrajsinh Vaghela

By Yuvrajsinh Vaghela