Contents

A neobank spent 14 months building a platform only to discover their payment architecture couldn’t handle 200 concurrent transactions—a threshold they hit in week one. A lending platform watched 68% of applicants abandon forms halfway through. That’s what happens when fintech website development is treated like standard web development.

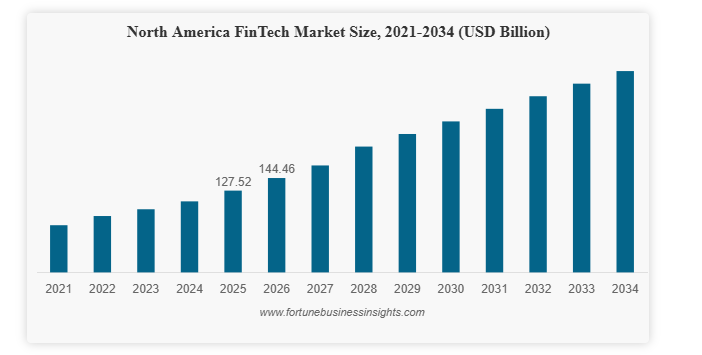

The stakes are massive. The global fintech market reached 460.76 billion in 2026 and will reach USD 1,760.18 billion by 2034, exhibiting a CAGR of 18.20% during the forecast period, according to Fortune Business Insights.

Yet McKinsey reports that 75% of fintech startups fail within five years because their platforms can’t deliver the speed, security, and compliance that financial services demand.

As a leading fintech web development company, we’ve built complex web applications handling real-time transactions, multi-system integrations, and strict compliance requirements.

With 6+ years of experience and 200+ successful projects, including InvoiceOwl (financial invoicing software) and MoovStore (multi-vendor ecommerce with payment processing), we understand what separates fintech success from expensive failure.

This guide covers everything you need:

- What fintech website development involves and how it differs from standard web development

- Types of fintech platforms and which model fits your business

- Must-have features for security, compliance, and user trust

- Step-by-step development process from planning to launch

- Security and regulatory compliance requirements

- Realistic cost breakdown and timeline expectations

- How to choose the right fintech development partner

Let’s dive in.

What Is Fintech Website Development?

Fintech website development is the process of building web-based platforms that deliver financial services or support financial operations through technology. It covers everything from digital banking interfaces and investment dashboards to payment processing systems, lending platforms, and insurance portals.

But fintech web development is fundamentally different from building a standard website or ecommerce store. Here’s why.

How it differs from standard web development

A typical web application processes content and handles purchases. A fintech platform handles sensitive financial data, processes real-time monetary transactions, and must comply with regulations like PCI DSS, SOC 2, and GDPR—with penalties for violations reaching millions of dollars.

The key differences include:

- Regulatory compliance governing how data is collected, stored, and transmitted

- Transaction integrity where a single processing error causes direct financial loss

- Security requirements including end-to-end encryption, tokenization, and real-time fraud monitoring

- Uptime expectations where minutes of downtime permanently erode user trust

- Audit requirements demanding logs of every data access and transaction for regulatory review

These differences mean fintech website development requires developers who understand financial systems, regulatory frameworks, and security architecture—not just code.

Why businesses invest in custom fintech platforms

Off-the-shelf financial software works for basic needs. But businesses pursuing differentiation invest in custom fintech development because it enables proprietary algorithms for lending, risk assessment, or investment recommendations that competitors can’t replicate. It allows integration with specific banking partners and data providers. And it gives full control over user experience, data architecture, and compliance—control that becomes critical as the platform scales.

According to PitchBook, companies with proprietary technology platforms are 3x more likely to secure Series B funding. The investment pays dividends in both user acquisition and company valuation.

Pro Tip: Identify your regulatory obligations before writing a single line of code—compliance gaps discovered mid-development cost multiples of what upfront planning requires.

What does fintech website development cost include?

Fintech website development cost includes planning, UI/UX design, backend development, security implementation, regulatory compliance, third-party integrations, testing, deployment, and post-launch maintenance. Costs increase significantly when platforms handle real-time transactions, sensitive financial data, or operate across multiple regulatory jurisdictions.

Now that you understand what fintech website development involves, let’s explore the different types of fintech websites businesses can build to deliver digital financial services.

6 Types of Fintech Websites You can Build for Your Organization

Not all fintech platforms serve the same purpose. Before diving into website development, you need to understand which model aligns with your target audience, revenue strategy, and compliance obligations. Here are the six primary fintech categories.

1. Digital banking platforms

Digital banking platforms deliver traditional banking services—account management, transfers, bill payments, card management—through web and mobile interfaces without physical branches. Neobanks like Chime and Revolut have collectively attracted over 200 million users worldwide.

Building one involves the most complex fintech development challenges: KYC/AML verification during onboarding, real-time transaction processing for thousands of concurrent operations, and integration with banking networks and regulatory reporting systems. Regulatory requirements vary by jurisdiction—US platforms navigate federal banking regulations and state money transmitter licenses, while European platforms must meet PSD2 open banking requirements.

2. Payment processing platforms

Payment platforms facilitate monetary transactions between parties like consumer-to-business, business-to-business, or peer-to-peer. Users expect sub-second processing, multi-currency support, and diverse payment method acceptance.

PCI DSS compliance is non-negotiable. The high transaction volumes make performance optimization and infrastructure reliability critical engineering concerns. Stripe, Square, and PayPal set the standard for what users expect.

3. Lending and credit platforms

Digital lending platforms streamline loan origination—from application and credit assessment to approval, disbursement, and repayment management. Development challenges center on accurate credit scoring algorithms, automated document verification, and lending regulations that vary by state and country.

Platforms that automate traditionally manual processes like underwriting can reduce loan processing times from weeks to minutes, a significant competitive advantage.

4. Investment and wealth management platforms

Investment platforms range from self-directed trading apps to robo-advisors automating portfolio management. Market data feeds deliver thousands of price updates per second. Portfolio calculations must account for tax implications and risk parameters. SEC and FINRA regulations affect everything from account opening to trade execution.

5. Insurtech platforms

Insurtech platforms modernize the insurance lifecycle, including policy comparison, purchase, claims filing, and management. Lemonade demonstrated that AI-powered claims processing could reduce resolution times from weeks to seconds.

Development requires underwriting algorithm integration, policy management systems, claims workflows, and navigation of a regulatory landscape that varies by state.

6. Personal finance platforms

Personal finance platforms help users track spending, set budgets, and plan financial goals. The primary development challenge is data aggregation, which securely connects to users’ bank accounts, credit cards, and investment accounts through APIs like Plaid or Yodlee to present a unified financial picture.

Understanding your platform type is the first step. The next question is: what features does it need? Let’s explore the essentials.

7 Must-Have Features to Integrate During Fintech Platform Development

The right features determine whether your fintech platform earns user trust or drives them to competitors. Here are the non-negotiable features for successful fintech website development:

1. Multi-factor authentication and identity verification

Weak authentication exposes users to account takeover attacks—a threat that cost the financial sector $45.8 billion in 2023, according to Juniper Research. Implement MFA combining passwords with device-based codes or biometrics, adaptive authentication that escalates security for high-risk actions, and session management with automatic timeouts and device tracking.

2. KYC and AML compliance workflows

KYC (Know Your Customer) and AML (Anti-Money Laundering) verification are legal obligations with severe penalties. Your platform needs document upload and automated verification, liveness detection to prevent fraud, risk-based verification tiers, and integration with providers like Jumio, Onfido, or Trulioo.

3. Real-time transaction processing

Users expect payments processed in seconds and balances updated immediately. This requires sub-second processing with idempotency guarantees, atomic operations ensuring transactions complete fully or roll back entirely, and velocity checks flagging suspicious activity. These requirements directly influence your database and API architecture.

4. Personalized financial dashboards

Dashboards translate complex financial data into actionable insights and bring users back to the platform regularly. Include account overviews with balances and recent transactions, visual analytics with intuitive charts, customizable views, goal tracking, and export capabilities. Dashboards must load quickly even with large datasets—lazy loading and efficient queries are essential.

5. Smart notification systems

Timely notifications build confidence that users’ money is being monitored. Include transaction confirmations, security alerts for login attempts and new devices, balance threshold warnings, and payment reminders. Multi-channel delivery—email, SMS, push notifications, in-app alerts—ensures users receive critical information through their preferred channel.

6. API integrations and open banking connectivity

Modern fintech platforms connect with banking networks (Plaid, Yodlee), payment processors (Stripe, Adyen), credit bureaus, and market data providers. Open banking regulations in Europe (PSD2) and emerging frameworks elsewhere are standardizing bank API access, creating new opportunities for platforms that leverage these connections effectively.

7. Robust admin panel and reporting

Platform operators need visibility into user analytics, transaction monitoring, compliance dashboards, and revenue tracking. Built-in reporting tools enable data-driven decisions and regulatory reporting.

Pro Tip: Start with core features that enable transactions and compliance, then add advanced functionality based on real user data. Feature bloat kills fintech MVPs.

Need Help Defining Your Fintech Features?

Our web development consultants help you identify the right features for your specific market, compliance requirements, and business model. Get expert guidance before you build.

Having the right features defines your fintech platform’s capabilities, but a proven website development process determines how efficiently and securely those features are built and deployed. Check what a top website development company follows to build a website for fintech organizations.

How to Develop a Fintech Website: Step-by-Step Process

Building a fintech platform requires strategic planning, security-first execution, and continuous optimization. Here’s the step-by-step process for fintech website development that actually works:

Step 1: Discovery and regulatory planning

Define clear business goals and target audience. Map applicable regulations by jurisdiction and feature—KYC levels, data handling rules, reporting obligations. Validate your business model. Conduct competitor analysis to identify gaps and differentiation opportunities. Prioritize features for your MVP.

This phase takes 2-4 weeks and produces documentation guiding every subsequent decision. Skipping discovery is the most common cause of fintech project failures.

Step 2: Architecture and technology selection

Choose a technology stack matching your platform’s requirements:

- React.js + Node.js: Real-time dashboards, API-heavy platforms

- Python + Django: Data-intensive platforms with ML for credit scoring or fraud detection

- Java + Spring Boot: Enterprise-grade systems requiring proven reliability at massive scale

- PostgreSQL: Default for financial transactions (strict ACID compliance)

- AWS / Google Cloud: Infrastructure with SOC 2, PCI DSS, HIPAA certifications

Design your system architecture, security framework, integration approach, and infrastructure strategy. At Monocubed, we follow a systematic 6-phase process, including ideation, research, design, development, testing, and maintenance, ensuring architectural decisions receive proper attention before coding begins.

Step 3: UI/UX design with trust in mind

Fintech design balances aesthetics with regulatory requirements and trust signals. Certain disclosures, terms, and warnings must appear at specific points in user workflows.

Focus on these design priorities:

- Trust indicators: Security badges, compliance certifications, transparent fee displays

- Confirmation screens: For irreversible financial actions

- Mobile-first design: 76% of banking interactions happen on mobile (J.D. Power)

- Accessible design: WCAG 2.1 AA compliance as minimum

- Progressive disclosure: Show only information relevant to the current step

Test prototypes with real users before committing development resources.

Step 4: Security-first development

Website development must follow security-first principles. Every code contribution passes security review before integration. Code reviews use security-focused checklists. Input validation happens on both client and server. Data handling uses industry-standard encryption libraries. Secrets live in vault systems, never in hardcoded credentials.

Critical integrations happen during this phase, such as payment processors, KYC providers, banking APIs, and notification services all connect to your platform’s core infrastructure. The leading website development companies for fintech expertise follow the best security practices.

There are so many ways you can improve the security of your site and make it reliable for the users.

Step 5: Testing and security audits

Fintech testing goes far beyond checking that features work:

- Functional testing: Verify every feature works as specified

- Security testing: Penetration testing and vulnerability scanning

- Performance testing: Simulate realistic and peak traffic loads

- Compliance testing: Verify regulatory requirement implementation

- Integration testing: Confirm all external service connections work reliably

- Disaster recovery testing: Validate backup and failover procedures

Third-party security audits provide independent verification. For platforms handling significant transaction volumes, annual penetration testing is the minimum standard.

Step 6: Launch and ongoing maintenance

Launch preparation includes regulatory notifications, compliance documentation, and monitoring systems for real-time anomaly detection.

Pre-launch checklist:

- All security audits passed

- Compliance documentation complete

- Monitoring and alerting active

- Backup verification complete

- Support team trained

- Incident response procedures documented

Post-launch, fintech platforms require ongoing maintenance exceeding typical web applications, typically 15-20% of initial development cost annually for security patches, compliance updates, and performance optimization.

Pro Tip: Run a soft launch with limited users first to identify payment errors, security gaps, or compliance issues before full public launch.

Before moving forward with development, it’s essential to understand the security and regulatory requirements that shape every stage of fintech platform creation.

Security and Regulatory Compliance in Fintech Development

Security isn’t a feature of fintech platforms; it’s the foundation. Here’s what compliance looks like in practice.

1. PCI DSS compliance

Any platform processing, storing, or transmitting credit card data must comply with PCI DSS—12 requirement categories covering network security, data protection, access control, and monitoring.

Key requirements include:

- Network segmentation isolating cardholder data

- Encryption of stored card data using approved algorithms

- Encrypted transmission across public networks

- Access controls limiting data to personnel with business need

- Regular vulnerability assessments and penetration testing

- Comprehensive logging of all cardholder data access

Working with PCI-compliant processors like Stripe reduces your compliance scope by keeping raw card data off your servers.

2. Data encryption and privacy

Fintech platforms must encrypt sensitive data both in transit and at rest:

- TLS 1.3 for all data in transit

- AES-256 encryption for data at rest

- Field-level encryption for sensitive data like social security numbers

- Key management using hardware security modules (HSMs)

- Data masking in logs, error messages, and non-production environments

GDPR, CCPA, and other privacy regulations add requirements for data access requests, deletion rights, and consent management.

3. SOC 2 certification

SOC 2 demonstrates your platform meets standards for security, availability, processing integrity, confidentiality, and privacy. Many enterprise clients and banking partners require SOC 2 Type II certification before integrating with your platform. Achieving it involves implementing controls across five trust service categories and maintaining them over a 6-12 month audit period.

4. Regional regulatory frameworks

Fintech regulation varies significantly by geography:

- United States: SEC, FINRA, OCC, state money transmitter licenses, Dodd-Frank Act

- European Union: PSD2, MiFID II, GDPR, country-specific requirements

- United Kingdom: FCA authorization, open banking standards

- Canada: FINTRAC, PIPEDA, provincial securities regulations

Engage compliance consultants during discovery, the cost of expert guidance upfront is a fraction of remediation costs after a regulatory audit reveals gaps.

Building a Compliant Fintech Platform?

Monocubed builds fintech websites with security and compliance built into the architecture from day one. Our team understands PCI DSS, SOC 2, and regional regulatory requirements.

How Much Does it Cost to Develop a Fintech Website?

Fintech website development costs typically range from $20,000 to $300,000+, depending on platform complexity, feature depth, security architecture, and regulatory compliance requirements such as PCI DSS and SOC 2.

The initial development quote rarely captures the total cost of ownership, which includes compliance audits, infrastructure, security monitoring, and ongoing maintenance.

Understanding the cost drivers can help you plan your budget more accurately. Here’s what to expect:

Cost estimates by platform complexity

Fintech website development costs vary by platform type and compliance scope. The table below shows typical cost ranges, timelines, and feature scope based on real fintech development projects.

| Platform Type | Estimated Cost | Timeline | Scope |

|---|---|---|---|

| MVP / Basic Fintech | $25,000-$50,000 | 3-4 months | Core features, basic compliance |

| Mid-Range Platform | $50,000-$120,000 | 5-8 months | Full features, standard compliance |

| Enterprise Platform | $120,000-$300,000+ | 8-14 months | Advanced features, full compliance, complex integrations |

Key factors that drive fintech website development cost

Key factors that drive fintech website development cost are primarily related to security, compliance, feature complexity, and third-party integrations. Each of the following elements directly increases development effort, testing requirements, and long-term operational expenses.

- Feature complexity: Basic payment processing vs. multi-currency with real-time conversion

- Compliance requirements: PCI DSS adds $20,000-$50,000; SOC 2 adds $30,000-$100,000

- Third-party integrations: Simple API connections ($2,000-$5,000 each) vs. complex banking integrations ($15,000-$30,000+)

- Security infrastructure: Encryption, fraud detection, monitoring add 15-25% to base costs

Key website development phases and expenses

Building a secure, reliable financial platform requires investment across several stages:

- Discovery and planning ($5,000 – $20,000): Market research, workflow mapping, and compliance roadmap creation.

- UI/UX design ($5,000 – $15,000): High-trust, intuitive designs and interactive prototypes.

- Backend and security ($15,000 – $50,000): Core logic, secure authentication, encryption, and two-factor authentication.

- Compliance and audits ($10,000 – $50,000+): Certifications like PCI-DSS, GDPR, and other regulatory requirements.

How to allocate your fintech development budget wisely

Fintech platforms must prioritize compliance, security, and scalability before advanced features. A misallocated budget often leads to costly rework or regulatory exposure.

- Prioritize compliance first — Regulatory penalties far exceed the cost of upfront implementation

- Invest in security infrastructure — Breach costs average $5.9 million in financial services

- Plan for ongoing costs — Infrastructure ($2,000-$15,000/month), compliance maintenance ($10,000-$50,000/year), security monitoring ($5,000-$20,000/year)

- Reserve for post-launch maintenance — Budget 15-20% of initial build cost annually

- Start with MVP — Validate your market before building enterprise features

At Monocubed, we provide transparent cost estimates after a thorough discovery phase. Use our Web Cost Calculator for an instant project estimate, or schedule a consultation for a personalized quote.

Once you understand how security and compliance shape fintech platforms, the next step is choosing a development company that can implement these standards effectively.

How to Choose the Right Fintech Development Company

Choosing the wrong development partner is one of the most expensive mistakes a fintech company can make. Here’s how to evaluate and select an agency that delivers.

1. Assess fintech-specific experience

Look for partners who’ve built fintech platforms before—not just standard web apps. Ask about previous projects involving payment processing, KYC integration, regulatory compliance, and real-time transaction handling. Monocubed has delivered 200+ projects across industries requiring secure transactions, complex integrations, and compliance-grade architecture.

2. Evaluate security practices

Security capabilities are non-negotiable. Verify their secure development lifecycle, penetration testing experience, data handling policies, incident response procedures, and compliance documentation capabilities. Partners who can walk you through their exact security workflow are far more credible than those who simply claim security is a priority.

3. Review technical expertise

Ensure the team excels in fintech-relevant technologies—React.js, Node.js, Python, PostgreSQL, cloud infrastructure, and API integrations. At Monocubed, our 50+ certified full-stack developers bring expertise across modern stacks with proven experience in financial application development.

4. Check portfolio and references

Examine previous projects for quality, performance, and compliance. Client testimonials reveal communication quality, delivery reliability, and partnership approach. Our 98% client satisfaction rate reflects our commitment to every project.

5. Confirm post-launch support

Fintech platforms need continuous compliance updates, security patches, and feature evolution. Monocubed provides 90-day post-launch maintenance plus ongoing support options, because development doesn’t end at launch.

6. Align on budget and process

Transparency matters. Look for clear milestones, realistic timelines, and honest cost estimates. Monocubed’s systematic 6-phase process—ideation, research, design, development, testing, and maintenance—keeps projects on track and within budget.

Pro Tip: Choose a fintech development company that offers post-launch compliance support and security monitoring—regulatory requirements evolve constantly.

Monocubed: Your Trusted Fintech Website Development Partner

Building a successful fintech platform isn’t about following generic templates. It requires regulatory expertise, security-first architecture, and user experiences that earn trust before users hand over their financial data.

Our website development company has helped businesses build custom web solutions with real-time data processing, secure payment integrations, and compliance-grade infrastructure. Our team combines modern tech stacks (React.js, Node.js, Python Django), AI-powered development capabilities, and deep understanding of financial compliance requirements.

From digital banking platforms to payment processing systems and lending applications, we build fintech solutions that scale securely and meet regulatory standards across jurisdictions.

Your competitors are already building. Every month you wait costs market share.

Ready to Build Your Fintech Platform?

Monocubed combines technical expertise, security-first architecture, and compliance knowledge to bring your fintech vision to life. With 200+ projects delivered and 98% client satisfaction, we deliver fintech solutions that work.

Frequently Asked Questions

-

How much does it cost to develop a fintech website?

Fintech website development typically costs $25,000–$50,000 for basic MVPs, $50,000–$120,000 for mid-range platforms, and $120,000–$300,000+ for enterprise fintech solutions. Final pricing depends on compliance scope (PCI DSS, SOC 2), feature complexity, security architecture, and third-party integrations. Enterprise fintech platforms with AI-powered features and complex integrations cost $120,000–$300,000+. Key cost drivers include feature complexity, compliance requirements (PCI DSS, SOC 2), third-party integrations, and security infrastructure. At Monocubed, we provide transparent estimates after a thorough discovery phase—use our Web Cost Calculator for instant project estimates.

-

How long does fintech website development take?

Timeline depends on complexity. Basic MVP: 3–4 months. Full-featured platform: 5–8 months. Enterprise solution: 8–14 months. The discovery and compliance planning phase alone takes 2–4 weeks. Monocubed’s AI-powered development process can reduce timelines by up to 50% compared to traditional approaches. We balance speed with quality—rushing fintech development costs more in compliance fixes later.

-

What regulations does a fintech website need to comply with?

Requirements depend on your platform type and operating jurisdictions. Common requirements include PCI DSS for payment processing, KYC/AML for identity verification, GDPR or CCPA for data privacy, and sector-specific regulations from bodies like the SEC (investments), OCC (banking), or state insurance commissions. Engaging compliance consultants during planning prevents costly rework. At Monocubed, regulatory mapping is built into our discovery phase.

-

Can I start with an MVP and scale later?

Absolutely. Phased development is a proven fintech approach. Launch with core functionality—user authentication, basic transactions, essential compliance—then expand based on real user feedback and market validation. The key is building initial architecture to support future expansion, particularly security and compliance foundations that are difficult to retrofit. Most successful fintech companies start lean and evolve based on data.

-

What’s the best technology stack for fintech development?

It depends on your specific requirements. React.js with Node.js suits real-time dashboards and API-heavy platforms. Python with Django works well for data-intensive platforms with ML integration. Java with Spring Boot is ideal for enterprise-grade financial systems. PostgreSQL is preferred for financial transaction data due to strict ACID compliance. AWS or Google Cloud provide infrastructure with financial-grade certifications. At Monocubed, we recommend stacks based on your specific platform needs, not one-size-fits-all preferences.

-

How do I ensure my fintech platform is secure?

Security requires a multi-layered approach including end-to-end encryption using TLS 1.3 in transit and AES-256 at rest, multi-factor authentication for all users, regular penetration testing and vulnerability scanning, secure coding practices with mandatory code reviews, comprehensive audit logging for regulatory compliance, and third-party security audits for independent verification. At Monocubed, security is built into every layer of our development process with proactive updates—prevention costs far less than breach remediation.

-

Should I build custom or use a white-label solution?

Build custom when you need proprietary algorithms, unique user experiences, or complex integrations that differentiate your business. White-label solutions work for faster market entry with standard functionality. Consider your long-term strategy—custom platforms create defensible advantages but require larger upfront investment. Many successful fintech companies start with white-label components and gradually replace them with custom-built systems as they grow and understand their users better.

By Yuvrajsinh Vaghela

By Yuvrajsinh Vaghela